Growing Focus on Cost-Effective Solutions

The need for cost-effective drug development solutions is a significant driver for the Gastroretentive Drug Delivery Systems Outsourcing Market. Pharmaceutical companies are increasingly outsourcing their drug delivery system development to reduce operational costs and enhance efficiency. By leveraging the expertise of specialized outsourcing firms, companies can minimize the financial burden associated with in-house development. Market analysis indicates that outsourcing can lead to a reduction in development timelines and costs by up to 30%. This trend is likely to persist as companies seek to optimize their resources and improve their competitive edge in the market.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, hypertension, and gastrointestinal disorders is a primary driver for the Gastroretentive Drug Delivery Systems Outsourcing Market. As these conditions require long-term medication regimens, the demand for effective drug delivery systems that ensure sustained release and improved bioavailability is escalating. Reports indicate that chronic diseases account for a significant portion of healthcare expenditures, prompting pharmaceutical companies to seek outsourcing solutions that enhance drug efficacy and patient compliance. This trend is likely to continue, as the aging population further exacerbates the prevalence of these diseases, thereby creating a robust market for gastroretentive systems.

Advancements in Drug Formulation Technologies

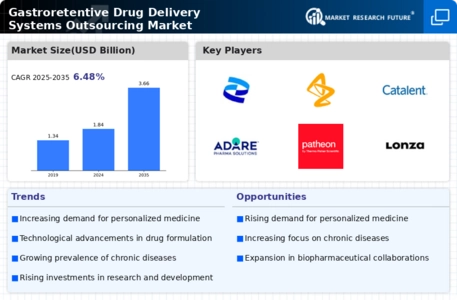

Technological innovations in drug formulation are propelling the Gastroretentive Drug Delivery Systems Outsourcing Market forward. The development of novel polymers and excipients that enhance the gastroretentive properties of drugs is gaining traction. For instance, the use of hydrophilic matrices and floating systems has shown promise in improving drug release profiles. Market data suggests that The Gastroretentive Drug Delivery Systems Outsourcing Market is projected to grow significantly, with a substantial portion attributed to gastroretentive systems. This growth is indicative of the increasing reliance on outsourcing partners who specialize in these advanced formulation technologies, allowing pharmaceutical companies to focus on core competencies while ensuring high-quality product development.

Rising Demand for Extended Release Formulations

The growing preference for extended release formulations is a key driver for the Gastroretentive Drug Delivery Systems Outsourcing Market. Patients and healthcare providers are increasingly favoring formulations that provide prolonged therapeutic effects and reduce dosing frequency. This trend is particularly evident in the management of chronic conditions, where adherence to medication regimens is crucial. Market data suggests that the extended release segment is expected to witness substantial growth, prompting pharmaceutical companies to explore outsourcing options for the development of gastroretentive systems. This shift not only enhances patient compliance but also positions companies to meet the evolving demands of the healthcare landscape.

Regulatory Support for Innovative Drug Delivery Systems

Regulatory bodies are increasingly supportive of innovative drug delivery systems, which is positively influencing the Gastroretentive Drug Delivery Systems Outsourcing Market. Initiatives aimed at expediting the approval process for novel drug delivery technologies are encouraging pharmaceutical companies to invest in gastroretentive systems. The introduction of guidelines that facilitate the development and approval of these systems is likely to enhance market growth. Furthermore, as regulatory frameworks evolve to accommodate advancements in drug delivery, outsourcing partners that are well-versed in compliance will be in high demand, ensuring that products meet stringent quality standards.