Rising Prevalence of Chronic Diseases

The Electronic Drug Delivery Systems Market is significantly influenced by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions. As these diseases become more common, the need for effective and reliable drug delivery systems intensifies. For example, the World Health Organization has reported that chronic diseases account for nearly 70% of all deaths worldwide, underscoring the urgent need for innovative solutions. Electronic drug delivery systems offer the potential for better management of these conditions through features like automated dosing and patient monitoring. This trend is likely to drive market growth as healthcare providers seek to improve patient outcomes and reduce healthcare costs associated with chronic disease management.

Regulatory Support and Standardization

The Electronic Drug Delivery Systems Market benefits from increasing regulatory support and standardization efforts aimed at ensuring the safety and efficacy of drug delivery technologies. Regulatory bodies are recognizing the importance of electronic systems in improving patient care and are establishing guidelines to facilitate their development and approval. For instance, the U.S. Food and Drug Administration has introduced frameworks that streamline the approval process for innovative drug delivery devices. This regulatory support is likely to encourage investment in research and development, leading to the introduction of new and improved electronic drug delivery systems. As the market matures, standardization will also play a crucial role in ensuring interoperability and compatibility among different systems, further driving market growth.

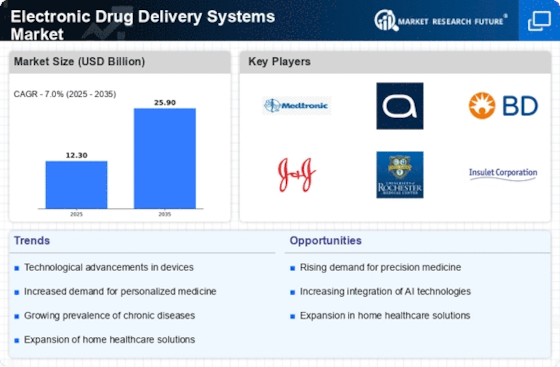

Technological Advancements in Drug Delivery

The Electronic Drug Delivery Systems Market is experiencing a surge in technological advancements that enhance the efficacy and precision of drug administration. Innovations such as micro-needles, smart inhalers, and wearable devices are revolutionizing how medications are delivered. For instance, the integration of IoT technology allows for real-time monitoring of drug delivery, which can lead to improved patient outcomes. According to recent data, the market for electronic drug delivery systems is projected to grow at a compound annual growth rate of approximately 8.5% over the next five years. This growth is driven by the increasing demand for more efficient and patient-friendly drug delivery methods, which are essential in managing chronic conditions and improving adherence to treatment regimens.

Growing Demand for Home Healthcare Solutions

The Electronic Drug Delivery Systems Market is experiencing a growing demand for home healthcare solutions, driven by the increasing preference for at-home treatment options among patients. This trend is particularly evident in the management of chronic diseases, where patients seek more convenient and comfortable ways to receive their medications. Electronic drug delivery systems that facilitate self-administration, such as pre-filled syringes and portable infusion pumps, are becoming more prevalent. Market analysis suggests that the home healthcare segment is expected to expand significantly, with a projected growth rate of over 10% in the coming years. This shift towards home-based care not only enhances patient satisfaction but also reduces the burden on healthcare facilities, making electronic drug delivery systems an attractive option for both patients and providers.

Increased Focus on Patient-Centric Solutions

The Electronic Drug Delivery Systems Market is witnessing a shift towards patient-centric solutions, which prioritize the needs and preferences of patients in the design and implementation of drug delivery systems. This trend is fueled by the growing recognition of the importance of patient engagement in healthcare. Systems that offer personalized dosing schedules, user-friendly interfaces, and mobile app integration are becoming increasingly popular. Research indicates that patient adherence to medication regimens improves significantly when they are involved in their treatment plans. As a result, manufacturers are investing in developing electronic drug delivery systems that cater to individual patient needs, thereby enhancing the overall effectiveness of treatment and fostering a more collaborative healthcare environment.