Government Regulations and Standards

Government regulations and standards play a pivotal role in shaping the Gas Insulated Medium Voltage Switchgear Market. Stricter environmental regulations and safety standards are compelling manufacturers to innovate and enhance the performance of their products. Compliance with these regulations often requires the adoption of gas insulated switchgear, which is known for its lower environmental impact compared to traditional switchgear. As governments worldwide implement policies aimed at reducing carbon emissions, the demand for eco-friendly switchgear solutions is likely to rise. The market is projected to grow by approximately 4.5% annually as companies adapt to these regulatory changes. Thus, the Gas Insulated Medium Voltage Switchgear Market is expected to benefit from increased investments in compliant technologies.

Rising Demand for Renewable Energy Sources

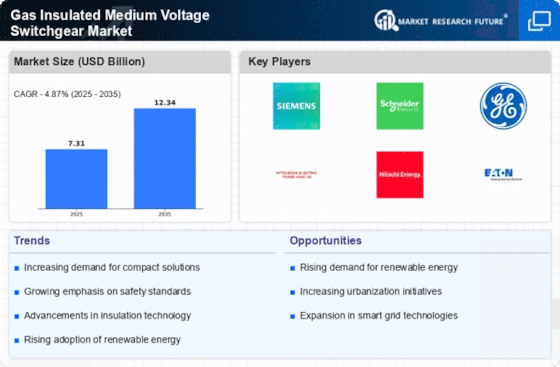

The transition towards renewable energy sources is significantly influencing the Gas Insulated Medium Voltage Switchgear Market. As countries strive to meet their energy needs sustainably, the integration of renewable energy systems such as wind and solar power is becoming more prevalent. This shift necessitates the use of reliable and efficient switchgear to manage the variable nature of renewable energy generation. The market is expected to expand as utilities and energy producers invest in modernizing their infrastructure to accommodate these energy sources. In fact, the demand for gas insulated switchgear is projected to increase by 7% annually, reflecting the industry's response to the growing emphasis on clean energy. Consequently, the Gas Insulated Medium Voltage Switchgear Market is poised for substantial growth as it aligns with global energy trends.

Urbanization and Infrastructure Development

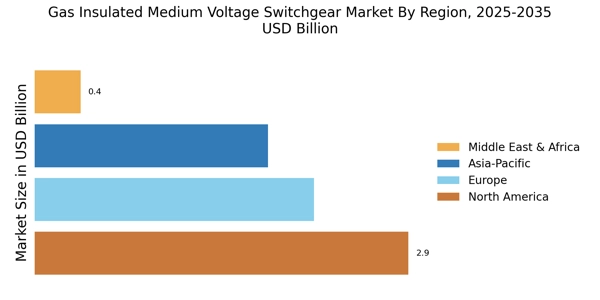

Rapid urbanization and infrastructure development are key drivers of the Gas Insulated Medium Voltage Switchgear Market. As urban areas expand, the demand for reliable electrical distribution systems increases. Gas insulated switchgear offers a compact solution ideal for urban settings where space is limited. The ongoing construction of smart cities and modern infrastructure projects necessitates the deployment of advanced electrical systems, including gas insulated switchgear. According to recent estimates, the market is anticipated to grow by 5% annually, fueled by investments in urban infrastructure. This trend indicates a shift towards more efficient and space-saving technologies in electrical distribution, positioning the Gas Insulated Medium Voltage Switchgear Market as a critical component in future urban planning.

Increased Investment in Smart Grid Technologies

The ongoing investment in smart grid technologies is significantly impacting the Gas Insulated Medium Voltage Switchgear Market. Smart grids require advanced electrical infrastructure capable of handling real-time data and automated control systems. Gas insulated switchgear, with its compact design and reliability, is well-suited for integration into smart grid frameworks. The market is expected to witness a growth rate of around 6% annually as utilities and energy providers modernize their systems to enhance efficiency and reliability. This trend is further supported by government initiatives promoting smart grid development, which aim to improve energy management and reduce outages. Consequently, the Gas Insulated Medium Voltage Switchgear Market is likely to thrive as it aligns with the broader shift towards intelligent energy solutions.

Technological Advancements in Gas Insulated Medium Voltage Switchgear

The Gas Insulated Medium Voltage Switchgear Market is experiencing a surge in technological advancements that enhance operational efficiency and reliability. Innovations such as digital monitoring systems and automated control mechanisms are being integrated into switchgear designs. These advancements not only improve performance but also reduce maintenance costs, making them more appealing to utility companies and industrial users. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by the demand for smarter grid solutions. Furthermore, the introduction of eco-friendly materials in switchgear construction aligns with sustainability goals, further propelling market growth. As technology continues to evolve, the Gas Insulated Medium Voltage Switchgear Market is likely to witness increased adoption across various sectors.