North America : Market Leader in MRO Services

North America continues to lead the Gas and Oil Refining Valve Systems MRO Services market, holding a significant share of 2.75 in 2024. The region's growth is driven by increasing investments in infrastructure, stringent regulatory frameworks, and a focus on operational efficiency. The demand for advanced valve systems is further propelled by the need for enhanced safety and environmental compliance, making it a key area for innovation and development.

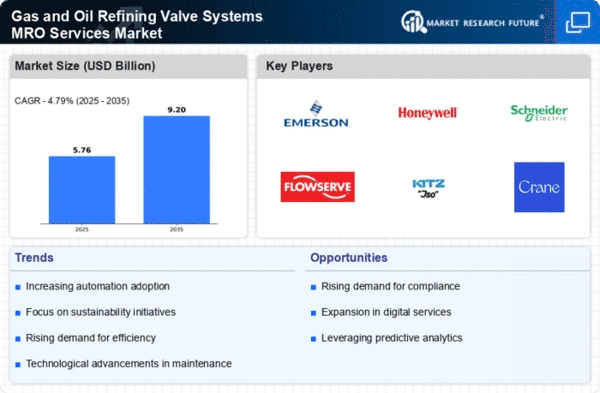

The competitive landscape in North America is robust, featuring major players like Emerson Electric Co, Honeywell International Inc, and Flowserve Corporation. These companies are leveraging technological advancements to improve service delivery and product offerings. The presence of a well-established supply chain and skilled workforce further strengthens the market position, ensuring that North America remains at the forefront of the MRO services sector.

Europe : Emerging Market with Growth Potential

Europe's Gas and Oil Refining Valve Systems MRO Services market is valued at 1.5, reflecting a growing demand driven by regulatory support and sustainability initiatives. The European Union's commitment to reducing carbon emissions and enhancing energy efficiency is catalyzing investments in modernizing existing infrastructure. This regulatory environment is expected to foster innovation and increase the adoption of advanced valve technologies across the region.

Leading countries in Europe, such as Germany, France, and the UK, are witnessing a surge in MRO activities, supported by key players like Schneider Electric SE and Valmet Oyj. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The focus on digital transformation and smart technologies is reshaping the industry, positioning Europe as a significant player in The Gas and Oil Refining Valve Systems MRO Services.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region, with a market size of 1.2, is experiencing rapid growth in the Gas and Oil Refining Valve Systems MRO Services sector. This growth is primarily driven by increasing investments in energy infrastructure and a rising demand for efficient and reliable valve systems. Countries like China and India are leading this trend, supported by government initiatives aimed at enhancing energy security and sustainability.

The competitive landscape in Asia-Pacific is evolving, with key players such as Kitz Corporation and Crane Co making significant inroads. The region is characterized by a mix of local and international companies, all striving to capture market share. As the demand for advanced MRO services continues to rise, the focus on innovation and technology adoption will be crucial for maintaining a competitive edge in this dynamic market.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of 0.05, presents a unique landscape for Gas and Oil Refining Valve Systems MRO Services. While the market is currently small, it is poised for growth due to increasing oil production and refining activities. However, challenges such as political instability and economic fluctuations can hinder progress. The region's focus on diversifying its economy is also driving investments in the oil and gas sector, creating opportunities for MRO services.

Countries like Saudi Arabia and the UAE are leading the charge in refining activities, with key players beginning to establish a foothold in the market. The competitive landscape is still developing, with local firms and international companies exploring partnerships to enhance service delivery. As the region stabilizes, the potential for growth in MRO services will become more pronounced, attracting further investments.