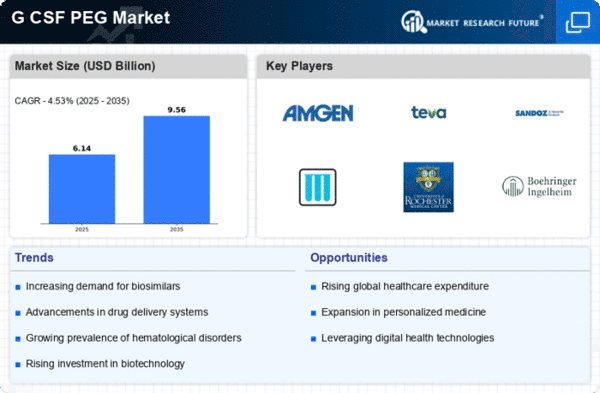

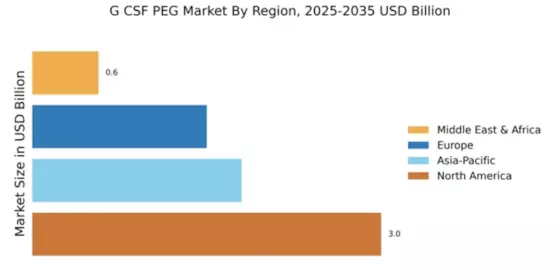

North America : Market Leader in G CSF PEG

North America is poised to maintain its leadership in the G CSF PEG G CSF market, holding a significant market share of 3.0 in 2025. The region's growth is driven by increasing cancer incidences, advancements in biotechnology, and supportive regulatory frameworks. The FDA's streamlined approval processes for biosimilars further enhance market accessibility, fostering innovation and competition.

The competitive landscape is characterized by major players such as Amgen, Teva, and Mylan, which are investing heavily in R&D to develop next-generation therapies. The U.S. remains the largest market, with Canada also showing promising growth. The presence of established pharmaceutical companies and a robust healthcare infrastructure contribute to the region's dominance, ensuring a steady supply of G CSF PEG products.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for G CSF PEG G CSF products, with a market size of 1.5 in 2025. The region's growth is fueled by increasing awareness of cancer treatments and supportive healthcare policies. Regulatory bodies are actively promoting the use of biosimilars, which is expected to enhance market penetration and affordability for patients across member states.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring key players like Roche and Sandoz. The European Medicines Agency (EMA) is facilitating faster approvals for innovative therapies, which is likely to boost market dynamics. The presence of a well-established healthcare system and ongoing clinical trials further solidify Europe's position in the G CSF PEG market.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is emerging as a significant player in the G CSF PEG G CSF market, with a market size of 1.8 in 2025. Factors driving this growth include rising cancer prevalence, increasing healthcare expenditure, and government initiatives aimed at improving healthcare access. Countries like China and India are investing in healthcare infrastructure, which is expected to enhance the availability of G CSF PEG products.

The competitive landscape is evolving, with local and international players vying for market share. Companies such as Eisai and Hikma Pharmaceuticals are expanding their presence in the region. The regulatory environment is becoming more favorable, with agencies streamlining approval processes for new therapies, thus fostering innovation and competition in the market.

Middle East and Africa : Developing Market with Challenges

The Middle East and Africa (MEA) region is gradually developing its G CSF PEG G CSF market, currently valued at 0.57 in 2025. The growth is primarily driven by increasing cancer cases and a rising demand for effective treatment options. However, challenges such as limited healthcare infrastructure and regulatory hurdles hinder rapid market expansion. Governments are focusing on improving healthcare access, which may catalyze future growth.

Countries like South Africa and the UAE are leading the market, with efforts to attract foreign investment in the pharmaceutical sector. The presence of key players is limited, but companies are beginning to explore opportunities in this region. As regulatory frameworks evolve, the potential for growth in the G CSF PEG market in MEA is promising, albeit gradual.