Fungicides Market Summary

As per Market Research Future analysis, the Fungicides Market Size was estimated at 21.16 USD Billion in 2024. The Fungicides industry is projected to grow from 22.06 USD Billion in 2025 to 33.41 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.24% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Fungicides Market is experiencing a notable shift towards sustainable practices and innovative technologies.

- The market is witnessing a significant shift towards bio-based fungicides, driven by increasing consumer demand for sustainable agriculture.

- Technological advancements in application methods are enhancing the efficiency and effectiveness of fungicide use across various crops.

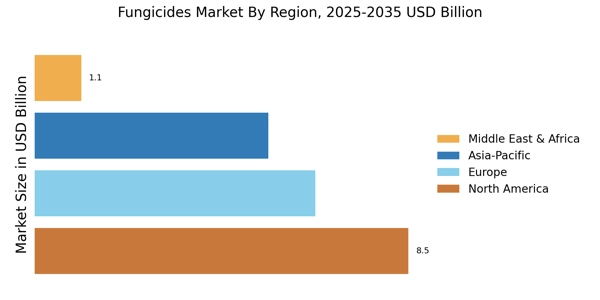

- North America remains the largest market for fungicides, while the Asia-Pacific region is emerging as the fastest-growing market due to rising agricultural activities.

- The increasing incidence of plant diseases and the demand for higher crop production are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 21.16 (USD Billion) |

| 2035 Market Size | 33.41 (USD Billion) |

| CAGR (2025 - 2035) | 4.24% |

Major Players

Bayer AG (DE), Syngenta AG (CH), BASF SE (DE), FMC Corporation (US), Corteva Agriscience (US), ADAMA Agricultural Solutions Ltd. (IL), Nufarm Limited (AU), UPL Limited (IN), Sumitomo Chemical Co., Ltd. (JP)