Market Growth Projections

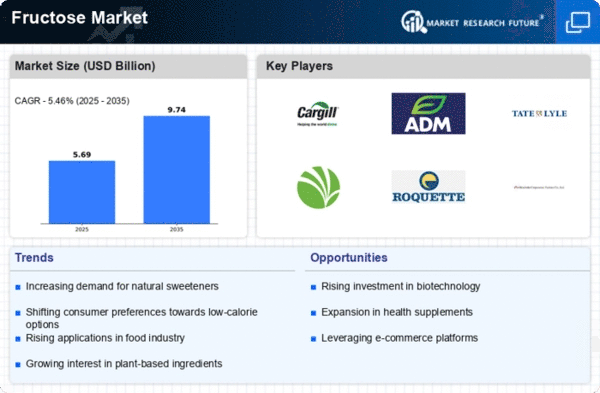

The Global Fructose Market Industry is projected to witness substantial growth in the coming years. With an estimated market value of 9.38 USD Billion in 2024, the industry is on a trajectory towards reaching 13.7 USD Billion by 2035. This growth is indicative of the increasing adoption of fructose across various sectors, including food and beverages, pharmaceuticals, and personal care products. The anticipated compound annual growth rate (CAGR) of 3.49% from 2025 to 2035 further underscores the potential for expansion within the market. These projections highlight the evolving landscape of the Global Fructose Market Industry and its capacity to adapt to changing consumer demands.

Health Benefits of Fructose

The Global Fructose Market Industry is propelled by the health benefits associated with fructose consumption. Research suggests that fructose may offer advantages over other sugars, such as a lower glycemic response, making it a preferred choice for individuals managing blood sugar levels. This perception is particularly relevant in the context of rising diabetes rates globally. As health-conscious consumers increasingly seek alternatives to traditional sugars, fructose's favorable attributes position it as a viable option. The ongoing emphasis on health and wellness is likely to sustain the growth of the Global Fructose Market Industry in the coming years.

Rising Demand for Natural Sweeteners

The Global Fructose Market Industry is experiencing a notable increase in demand for natural sweeteners as consumers become more health-conscious. This shift is largely driven by a growing awareness of the adverse effects of artificial sweeteners and high-calorie sugars. Fructose Market, derived from fruits and plants, is perceived as a healthier alternative, appealing to a broad demographic. In 2024, the market is projected to reach 9.38 USD Billion, reflecting this trend. As consumers seek products with lower glycemic indices, fructose's popularity is likely to continue rising, contributing to the overall growth of the Global Fructose Market Industry.

Technological Advancements in Production

Technological advancements in the production of fructose are enhancing efficiency and reducing costs within the Global Fructose Market Industry. Innovations in extraction and purification processes allow for higher yields and improved product quality. These advancements not only make fructose more accessible but also enable manufacturers to meet the growing demand for natural sweeteners. As production techniques evolve, the market is expected to witness a compound annual growth rate (CAGR) of 3.49% from 2025 to 2035. This growth is indicative of the industry's adaptability and responsiveness to consumer preferences, further solidifying fructose's role in the Global Fructose Market Industry.

Expansion of the Food and Beverage Sector

The Global Fructose Market Industry benefits significantly from the expansion of the food and beverage sector. As this sector grows, the demand for sweeteners, including fructose, increases correspondingly. Fructose Market is widely used in various applications, from soft drinks to baked goods, due to its sweetness and functional properties. The market's growth trajectory is further supported by innovations in product formulations that incorporate fructose to enhance flavor profiles. With projections indicating a market value of 13.7 USD Billion by 2035, the food and beverage industry's expansion is a critical driver of the Global Fructose Market Industry.

Regulatory Support for Natural Ingredients

Regulatory support for natural ingredients is fostering growth within the Global Fructose Market Industry. Governments worldwide are increasingly promoting the use of natural sweeteners as part of public health initiatives aimed at reducing sugar consumption. This regulatory environment encourages food manufacturers to reformulate products using fructose, aligning with consumer preferences for healthier options. As regulations evolve to favor natural ingredients, the demand for fructose is likely to rise, contributing to the market's expansion. The Global Fructose Market Industry stands to benefit from these supportive policies, which may enhance the overall perception and acceptance of fructose as a sweetening agent.