Diverse Culinary Applications

The versatility of strawberries in various culinary applications is a notable driver for the Fresh Strawberry Market. From desserts to salads and beverages, strawberries are increasingly being incorporated into diverse recipes, appealing to a wide range of consumers. This trend is supported by the growing popularity of gourmet cooking and the rise of food blogs and social media platforms that showcase innovative strawberry-based dishes. As culinary creativity flourishes, the demand for fresh strawberries is expected to grow, further propelling the Fresh Strawberry Market.

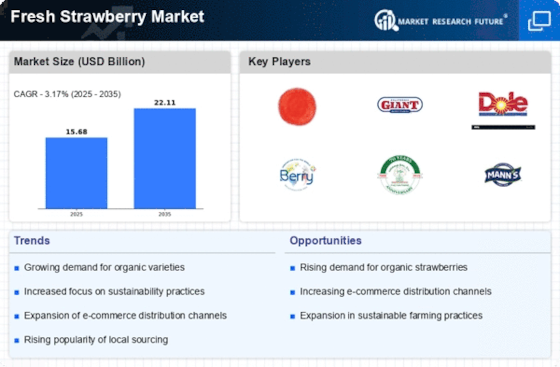

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a crucial factor influencing the Fresh Strawberry Market. Consumers are increasingly favoring products that are grown using environmentally friendly practices. This shift is prompting growers to adopt sustainable farming techniques, such as organic cultivation and reduced pesticide use. Data indicates that organic strawberries have seen a significant uptick in demand, reflecting a broader consumer preference for sustainable produce. As the market evolves, the emphasis on eco-friendly practices may not only enhance the appeal of strawberries but also contribute to the overall growth of the Fresh Strawberry Market.

Innovations in Supply Chain and Distribution

Innovations in supply chain management and distribution logistics are transforming the Fresh Strawberry Market. Enhanced transportation methods and improved cold chain logistics ensure that strawberries reach consumers in optimal condition, thereby reducing spoilage and waste. The implementation of advanced tracking technologies allows for better inventory management and timely deliveries. As a result, the availability of fresh strawberries is likely to increase, catering to the rising consumer demand. This evolution in supply chain dynamics may play a significant role in shaping the future of the Fresh Strawberry Market.

Health Consciousness and Nutritional Awareness

The increasing awareness of health and nutrition among consumers appears to be a pivotal driver for the Fresh Strawberry Market. Strawberries are recognized for their high vitamin C content, antioxidants, and dietary fiber, which align with the growing trend towards healthier eating habits. As consumers become more health-conscious, the demand for fresh fruits, particularly strawberries, is likely to rise. Reports indicate that the consumption of fresh strawberries has surged, with a notable increase in sales attributed to their perceived health benefits. This trend suggests that the Fresh Strawberry Market may continue to expand as more individuals seek nutritious options in their diets.

Rising Disposable Income and Consumer Spending

Rising disposable income levels across various demographics are likely to bolster the Fresh Strawberry Market. As consumers experience increased financial freedom, they tend to spend more on premium and fresh produce, including strawberries. Market data suggests that regions with higher disposable incomes have reported a marked increase in the purchase of fresh fruits. This trend indicates that as economic conditions improve, the demand for fresh strawberries may continue to rise, reflecting a broader shift towards quality and freshness in consumer purchasing behavior.

.png)