North America : Market Leader in Fresh Pet Food Market

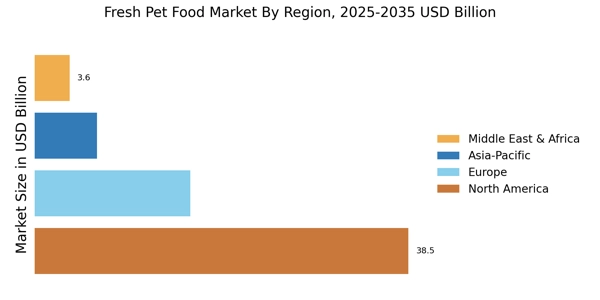

North America is the largest market for fresh pet food, accounting for approximately 60% of the global market share. The growth is driven by increasing pet ownership, a shift towards premium pet food products, and rising consumer awareness regarding pet health. Regulatory support for pet food safety and quality standards further catalyzes market expansion. The demand for fresh, natural ingredients is also on the rise, reflecting changing consumer preferences.

The United States is the leading country in this region, with key players like Freshpet, The Honest Kitchen, and Nom dominating the market. Canada also plays a significant role, contributing to the overall growth. The competitive landscape is characterized by innovation in product offerings and marketing strategies aimed at health-conscious pet owners. The presence of established brands ensures a robust market environment.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the fresh pet food market, holding approximately 25% of the global share. The growth is fueled by increasing pet ownership, a trend towards natural and organic pet food, and stringent regulations promoting pet health and safety. Countries like Germany and the UK are leading this market, with a growing demand for high-quality, fresh ingredients. Regulatory frameworks are evolving to support the industry's growth, ensuring product safety and quality.

Germany is the largest market in Europe, followed closely by the UK, where brands like Pets Deli and PetFoodies are gaining traction. The competitive landscape is marked by a mix of local and international players, focusing on premium offerings. The presence of innovative startups alongside established brands is driving product diversification and enhancing consumer choice, making Europe a dynamic market for fresh pet food.

Asia-Pacific : Rapid Growth in Pet Ownership

The Asia-Pacific region is emerging as a significant player in the fresh pet food market, accounting for about 10% of the global share. The growth is driven by rising disposable incomes, increasing pet ownership, and a growing awareness of pet nutrition. Countries like China and Japan are at the forefront, with a notable shift towards premium and fresh pet food products. Regulatory frameworks are gradually adapting to support this evolving market, ensuring safety and quality standards for pet food products.

China is the largest market in this region, with Japan following closely. The competitive landscape is characterized by both local and international brands, with key players like Pet Food Institute and local startups innovating in product offerings. The increasing demand for fresh, natural ingredients is reshaping the market, leading to a diverse range of products catering to health-conscious pet owners. The region's growth potential is significant as consumer preferences continue to evolve.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa region is still developing in the fresh pet food market, holding around 5% of the global share. The growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing trend towards pet ownership. Countries like South Africa and the UAE are leading this market, with a gradual shift towards premium pet food products. Regulatory frameworks are beginning to evolve, focusing on ensuring product safety and quality, which is crucial for market growth.

South Africa is the largest market in this region, with the UAE also showing promising growth. The competitive landscape is characterized by a mix of local brands and international players entering the market. The presence of key players is still limited, but the increasing demand for fresh and natural pet food is creating opportunities for new entrants. As consumer awareness grows, the market is expected to expand significantly in the coming years.