North America : Market Leader in Innovation

North America continues to lead the Digital Freight Brokerage Solutions Market, holding a significant market share of 3.75 in 2024. The region's growth is driven by technological advancements, increasing demand for efficient logistics, and supportive regulatory frameworks. The rise of e-commerce and the need for real-time tracking solutions further fuel this demand, making it a hotbed for innovation in freight brokerage.

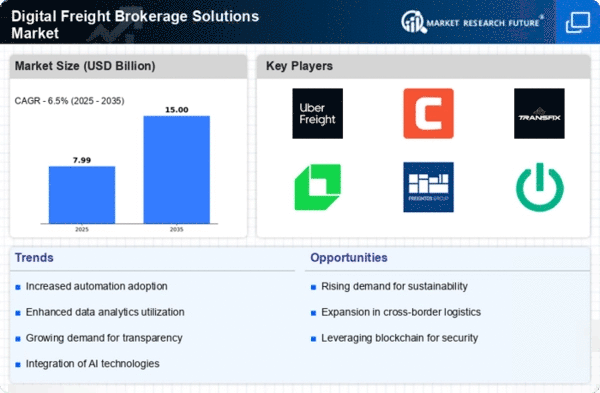

The competitive landscape is robust, with key players like Uber Freight, Convoy, and Transfix dominating the market. These companies leverage advanced technologies such as AI and machine learning to optimize freight operations. The presence of a well-established logistics infrastructure in the U.S. enhances the market's growth potential, positioning North America as a global leader in digital freight solutions.

Europe : Emerging Market with Growth Potential

Europe is witnessing a transformative phase in the Digital Freight Brokerage Solutions Market, with a market size of 2.25. The region's growth is propelled by increasing digitalization in logistics, regulatory support for innovation, and a strong focus on sustainability. European governments are promoting digital solutions to enhance supply chain efficiency, which is crucial for meeting the demands of a rapidly changing market landscape.

Leading countries such as Germany, France, and the UK are at the forefront of this evolution, with numerous startups and established companies competing for market share. Key players like Freightos and Project44 are making significant strides in the region, leveraging technology to streamline operations. The competitive environment is characterized by collaboration and partnerships, driving further innovation in digital freight solutions.

Asia-Pacific : Rapid Growth in Logistics Sector

The Asia-Pacific region is emerging as a significant player in the Digital Freight Brokerage Solutions Market, with a market size of 1.5. The growth is driven by rapid urbanization, increasing trade activities, and a shift towards digital solutions in logistics. Governments in the region are implementing policies to support technological advancements, which are crucial for enhancing supply chain efficiency and competitiveness in the global market.

Countries like China, India, and Australia are leading the charge, with a growing number of startups and established firms entering the digital freight space. The competitive landscape is evolving, with companies focusing on innovative solutions to meet the diverse needs of the market. The presence of key players is increasing, contributing to a dynamic and competitive environment in the region.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region currently shows minimal activity in the Digital Freight Brokerage Solutions Market, with a market size of 0.0. However, this region holds significant untapped potential due to increasing trade activities and a growing interest in digital logistics solutions. Governments are beginning to recognize the importance of digital transformation in logistics, which could catalyze future growth in this sector.

Countries like South Africa and the UAE are starting to invest in digital infrastructure, aiming to enhance their logistics capabilities. The competitive landscape is still developing, with few key players currently operating. However, as the region continues to evolve, opportunities for growth and innovation in digital freight solutions are expected to emerge, attracting new entrants and investments.