Focus on Industry 4.0

The France virtual engineering market is closely aligned with the principles of Industry 4.0, which emphasizes the integration of digital technologies into manufacturing processes. This paradigm shift is prompting companies to adopt virtual engineering solutions that enhance automation, data exchange, and real-time monitoring. The French manufacturing sector is projected to invest over 15 billion euros in digital transformation initiatives by 2027, indicating a strong commitment to embracing virtual engineering. As organizations strive to improve efficiency and competitiveness, the demand for virtual engineering services is expected to rise, further solidifying the industry's growth trajectory.

Increased Investment in R&D

The France virtual engineering market is experiencing a surge in research and development investments, driven by the need for innovation and competitive advantage. French companies are allocating significant resources to develop cutting-edge virtual engineering solutions that address complex engineering challenges. Recent statistics reveal that R&D spending in the engineering sector has increased by 12% in the past year, reflecting a growing recognition of the importance of technological advancement. This trend is likely to enhance the capabilities of the virtual engineering market, fostering the development of new tools and methodologies that can transform traditional engineering practices.

Government Initiatives and Support

The France virtual engineering market benefits from robust government initiatives aimed at fostering innovation and technological advancement. The French government has implemented various policies to support digital transformation across sectors, including engineering. For instance, the 'France 2030' plan allocates substantial funding to promote research and development in digital technologies. This initiative is expected to enhance the capabilities of the virtual engineering market, potentially leading to a projected growth rate of 10% annually. Furthermore, public-private partnerships are being encouraged to facilitate the adoption of virtual engineering solutions, thereby strengthening the overall ecosystem.

Advancements in Simulation Technologies

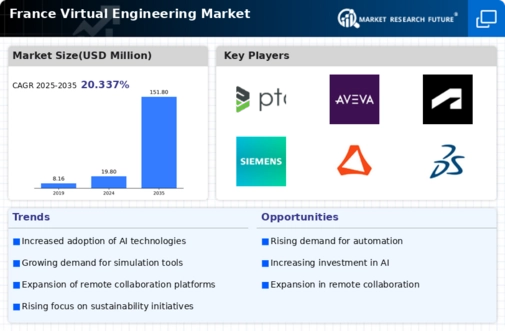

The France virtual engineering market is significantly influenced by advancements in simulation technologies, which are becoming integral to the design and testing processes. Innovations in computational fluid dynamics and finite element analysis are enabling engineers to create more accurate models and simulations. This technological evolution is expected to drive market growth, with estimates suggesting a compound annual growth rate of 8% over the next five years. As industries such as aerospace and automotive increasingly adopt these technologies, the demand for virtual engineering solutions is likely to expand, reinforcing the industry's position in the global market.

Growing Demand for Remote Collaboration

The France virtual engineering market is witnessing an increasing demand for remote collaboration tools, driven by the need for efficient project management and communication among geographically dispersed teams. As companies continue to embrace hybrid work models, the reliance on virtual engineering solutions has surged. Recent data indicates that approximately 65% of engineering firms in France are investing in collaborative technologies to enhance productivity. This trend is likely to propel the market forward, as organizations seek to optimize workflows and reduce operational costs through virtual engineering platforms.