Rising Demand for Automation

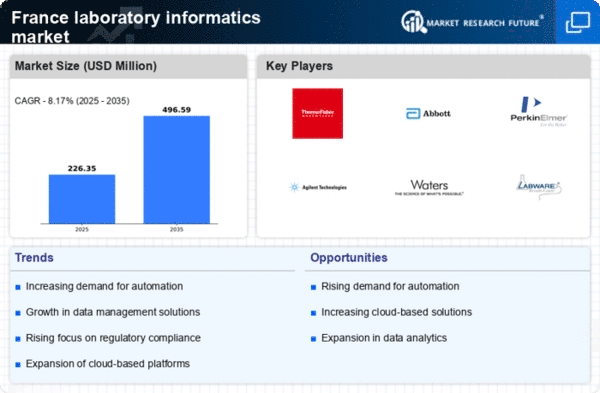

The laboratory informatics market in France is experiencing a notable surge in demand for automation solutions. This trend is driven by the need for increased efficiency and accuracy in laboratory processes. Automation minimizes human error and enhances productivity, allowing laboratories to handle larger volumes of samples. According to recent data, the automation segment is projected to grow at a CAGR of 10% through 2027. Laboratories are increasingly adopting automated systems for data collection, analysis, and reporting, which streamlines workflows and reduces turnaround times. This shift towards automation is likely to reshape the landscape of the laboratory informatics market, as organizations seek to optimize their operations and improve overall performance.

Emergence of Personalized Medicine

The shift towards personalized medicine is significantly impacting the laboratory informatics market in France. As healthcare providers increasingly adopt personalized treatment approaches, laboratories are required to manage and analyze complex data related to individual patient profiles. This trend necessitates the implementation of informatics solutions that can handle diverse data types and provide actionable insights. The market for personalized medicine informatics solutions is projected to grow at a rate of 11% over the next few years. Laboratories are investing in informatics systems that support genomic data analysis and patient-specific treatment plans, thereby enhancing the overall quality of care. This emergence of personalized medicine is likely to drive further innovation within the laboratory informatics market.

Growing Emphasis on Regulatory Compliance

In France, the laboratory informatics market is significantly influenced by the stringent regulatory environment governing laboratory operations. Compliance with regulations such as ISO standards and Good Laboratory Practices (GLP) is paramount for laboratories. As a result, there is a growing emphasis on informatics solutions that facilitate compliance and ensure data integrity. The market for compliance-focused laboratory informatics solutions is expected to expand. It has an estimated growth rate of 8% annually. Laboratories are increasingly investing in software that automates compliance documentation and reporting, thereby reducing the risk of non-compliance and enhancing operational efficiency. This focus on regulatory adherence is likely to drive innovation within the laboratory informatics market.

Advancements in Data Management Technologies

The laboratory informatics market is witnessing rapid advancements in data management technologies, which are crucial for handling the vast amounts of data generated in laboratory settings. In France, laboratories are increasingly adopting sophisticated data management systems that enable seamless integration and analysis of data from various sources. These technologies enhance data accessibility and facilitate informed decision-making. The market for data management solutions is projected to grow by 12% over the next five years. As laboratories strive to improve their data handling capabilities, the demand for advanced informatics solutions that support data visualization and analytics is likely to rise, further propelling the laboratory informatics market.

Increased Investment in Research and Development

Investment in research and development (R&D) is a key driver of growth in the laboratory informatics market in France. As organizations seek to innovate and develop new products, there is a corresponding need for advanced informatics solutions that support R&D activities. The French government has been actively promoting R&D initiatives, leading to increased funding and resources for laboratories. This trend is expected to boost the laboratory informatics market, with an anticipated growth rate of 9% in the R&D segment. Laboratories are leveraging informatics tools to streamline their research processes, manage data effectively, and enhance collaboration among research teams. This focus on R&D is likely to foster advancements in laboratory informatics solutions.