Rising Demand in Chemical Processing

The chemical processing sector in France is experiencing a notable increase in demand for precise fluid management solutions, which directly influences the dosing pump market. As industries seek to enhance operational efficiency and reduce waste, the need for accurate dosing systems becomes paramount. The market for dosing pumps in this sector is projected to grow at a CAGR of approximately 6% over the next five years. This growth is driven by the necessity for compliance with stringent quality standards and the desire to optimize production processes. Consequently, manufacturers are focusing on developing advanced dosing pump technologies that cater to the specific needs of chemical processing applications, thereby expanding their market presence.

Growth in Pharmaceutical Manufacturing

The pharmaceutical manufacturing sector in France is a critical driver for the dosing pump market. As the industry continues to innovate and expand, the need for precise dosing of active ingredients and excipients becomes increasingly vital. The market is projected to grow by approximately 7% over the next few years, fueled by advancements in drug formulation and production techniques. Dosing pumps play a crucial role in ensuring the accuracy and consistency of drug manufacturing processes, which is essential for regulatory compliance. As pharmaceutical companies invest in state-of-the-art production facilities, the demand for high-quality dosing pumps is likely to rise, further propelling market growth.

Expansion of Water Treatment Facilities

The ongoing expansion of water treatment facilities across France significantly impacts the dosing pump market. With increasing concerns over water quality and environmental regulations, municipalities are investing heavily in upgrading their water treatment infrastructure. This trend is expected to drive the demand for dosing pumps, which are essential for the accurate addition of chemicals in water purification processes. The market is anticipated to witness a growth rate of around 5% annually as new facilities are constructed and existing ones are retrofitted with modern dosing technologies. This shift not only enhances operational efficiency but also aligns with France's commitment to sustainable water management practices.

Increased Focus on Industrial Automation

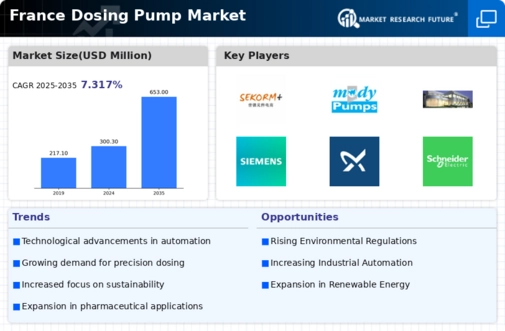

The trend towards industrial automation in France is reshaping the dosing pump market. As manufacturers seek to enhance productivity and reduce labor costs, the integration of automated dosing systems is becoming more prevalent. This shift is expected to drive market growth at a rate of around 6% annually, as companies invest in smart technologies that allow for real-time monitoring and control of fluid dosing processes. Automated dosing pumps not only improve accuracy but also minimize human error, making them an attractive option for various industries. The increasing adoption of Industry 4.0 principles is likely to further accelerate this trend, positioning the dosing pump market for sustained growth.

Emerging Applications in Food and Beverage

The food and beverage industry in France is increasingly recognizing the importance of precise dosing solutions, which is positively influencing the dosing pump market. As consumer preferences shift towards high-quality and safe products, manufacturers are compelled to adopt advanced dosing technologies to ensure consistency and compliance with food safety regulations. The market is projected to grow by approximately 4% annually, driven by the need for accurate dosing of ingredients and additives. This trend is further supported by the rising demand for automation in food processing, which enhances efficiency and product quality. Consequently, the dosing pump market is likely to see a surge in innovation and product development tailored to the unique requirements of the food and beverage sector.