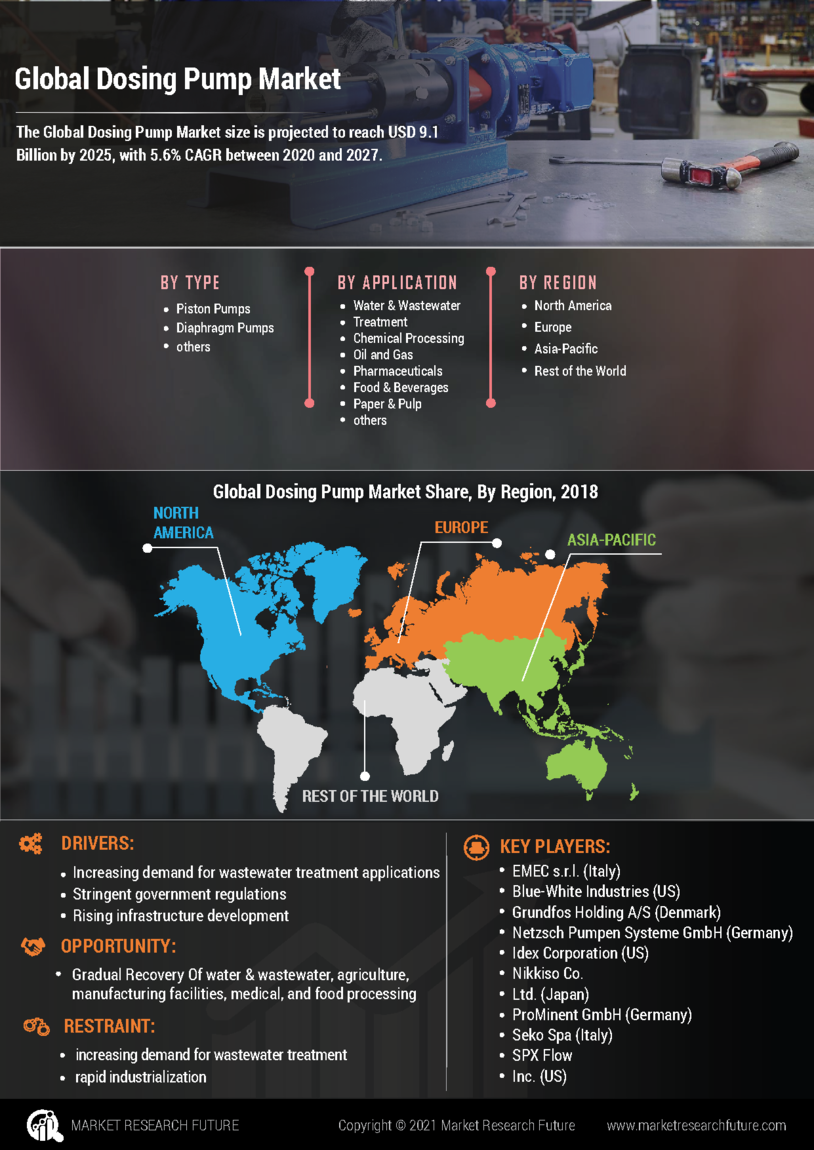

The Dosing Pump Market is currently experiencing a dynamic evolution, driven by various factors that influence its growth trajectory. The increasing demand for precise fluid management across diverse industries, such as water treatment, pharmaceuticals, and food processing, appears to be a primary catalyst.

Furthermore, advancements in technology, particularly in automation and digitalization, seem to enhance the efficiency and accuracy of dosing pumps. This trend indicates a shift towards more sophisticated systems that can integrate seamlessly with existing infrastructure, thereby improving operational performance. In addition, environmental regulations and sustainability initiatives are likely to shape the Dosing Pump Market significantly.

Companies are increasingly focusing on reducing waste and optimizing resource usage, which may lead to a preference for eco-friendly and energy-efficient dosing solutions. As industries strive to meet stringent compliance standards, the demand for innovative dosing technologies that align with these goals is expected to rise.

Overall, the Dosing Pump Market appears poised for substantial growth, driven by technological advancements and a heightened emphasis on sustainability.

Technological Advancements

The Dosing Pump Market is witnessing a surge in technological innovations, particularly in the realm of smart dosing systems. These advancements enable enhanced precision and control, allowing industries to optimize their operations and reduce waste. As automation becomes more prevalent, the integration of IoT and AI technologies into dosing pumps is likely to redefine operational standards.

Sustainability Initiatives

There is a growing focus on sustainability within the Dosing Pump Market, as manufacturers strive to create environmentally friendly solutions. This trend is driven by increasing regulatory pressures and consumer demand for greener products. Companies are exploring materials and designs that minimize environmental impact, which may lead to the development of more sustainable dosing technologies.

Rising Demand in Emerging Markets

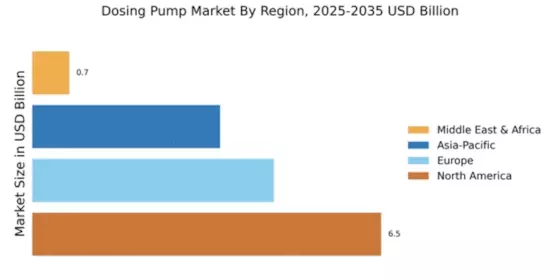

Emerging markets are showing a heightened interest in advanced dosing solutions, driven by rapid industrialization and urbanization. As these regions invest in infrastructure and manufacturing capabilities, the demand for efficient dosing systems is expected to rise. This trend presents opportunities for market players to expand their reach and cater to the evolving needs of these developing economies.