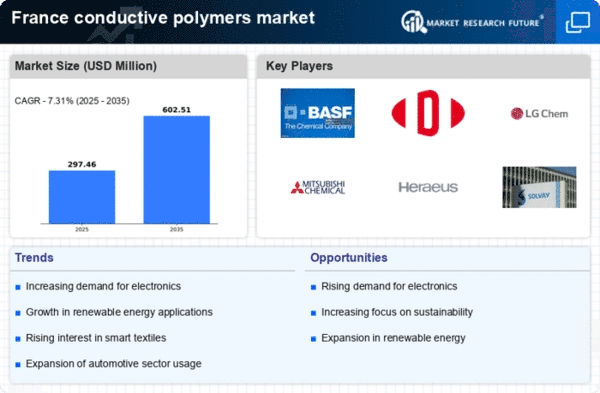

The conductive polymers market in France is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Key players such as BASF SE (DE), DuPont de Nemours Inc (US), and LG Chem Ltd (KR) are actively shaping the market through their distinct operational focuses. BASF SE (DE) emphasizes innovation in product development, particularly in applications for electronics and automotive sectors, while DuPont de Nemours Inc (US) is concentrating on expanding its portfolio of sustainable materials. LG Chem Ltd (KR) is leveraging its technological advancements to enhance the performance of conductive polymers, particularly in energy storage solutions. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological differentiation and sustainability.In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting influence over specific segments. This fragmentation allows for niche players to thrive, while larger corporations leverage their scale to drive innovation and market penetration.

In October BASF SE (DE) announced a partnership with a leading automotive manufacturer to develop next-generation conductive polymers aimed at improving electric vehicle performance. This collaboration underscores BASF's commitment to innovation and positions it strategically within the growing electric vehicle market, which is expected to expand significantly in the coming years. The partnership not only enhances BASF's product offerings but also aligns with the industry's shift towards sustainable transportation solutions.

In September DuPont de Nemours Inc (US) launched a new line of bio-based conductive polymers designed for use in consumer electronics. This strategic move reflects DuPont's focus on sustainability and its intent to capture a growing segment of environmentally conscious consumers. By integrating bio-based materials into its product line, DuPont is likely to enhance its competitive edge and appeal to manufacturers seeking sustainable alternatives.

In August LG Chem Ltd (KR) unveiled a new manufacturing facility in France dedicated to the production of advanced conductive polymers for energy storage applications. This investment not only signifies LG Chem's commitment to expanding its footprint in Europe but also highlights the increasing demand for high-performance materials in the renewable energy sector. The facility is expected to enhance supply chain efficiency and reduce lead times for European customers, thereby strengthening LG Chem's market position.

As of November the competitive trends in the conductive polymers market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in driving innovation and addressing complex market challenges. The competitive landscape is shifting from traditional price-based competition towards a focus on technological advancements, supply chain reliability, and sustainable practices. This evolution suggests that companies that prioritize innovation and strategic partnerships will likely emerge as leaders in the market.