Rising Cancer Incidence

The compounding chemotherapy market in France is experiencing growth due to the increasing incidence of cancer. According to recent statistics, cancer cases in France have risen by approximately 3.5% annually, leading to a heightened demand for tailored chemotherapy solutions. This trend is likely to continue as the population ages and lifestyle factors contribute to higher cancer rates. The compounding chemotherapy market is adapting to this surge by offering customized formulations that cater to the specific needs of patients, thereby enhancing treatment efficacy. As healthcare providers seek innovative solutions to combat cancer, the compounding chemotherapy market is positioned to play a crucial role in addressing these challenges, potentially leading to a market expansion valued at over €500 million by 2027.

Regulatory Framework Enhancements

The regulatory landscape surrounding the compounding chemotherapy market in France is evolving, with recent enhancements aimed at ensuring patient safety and product quality. Regulatory bodies are implementing stricter guidelines for compounding practices, which, while challenging, are likely to foster greater trust in compounded medications. The compounding chemotherapy market is adapting to these changes by ensuring compliance with new regulations, which may lead to improved product standards and increased market credibility. As pharmacies align their practices with regulatory expectations, the market could see a stabilization in growth, with an estimated increase in market share of 15% over the next few years.

Growing Demand for Customized Therapies

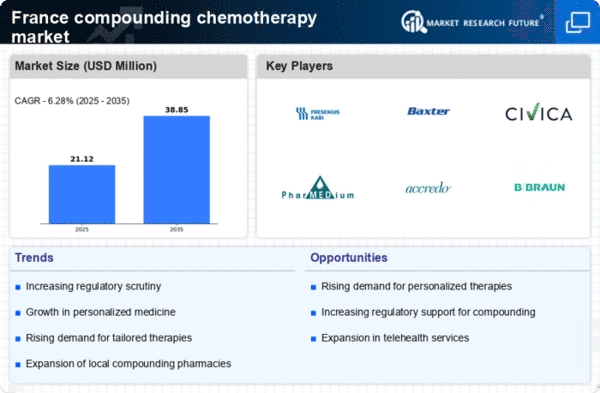

There is a notable shift towards personalized medicine within the compounding chemotherapy market in France. Patients increasingly seek therapies that are tailored to their unique genetic profiles and specific cancer types. This demand for customized therapies is prompting compounding pharmacies to develop specialized formulations that align with individual patient needs. The compounding chemotherapy market is responding by investing in research and development to create innovative solutions that enhance treatment effectiveness. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of 6% through 2028, reflecting the increasing preference for personalized treatment options among patients and healthcare providers.

Advancements in Pharmaceutical Technology

Technological advancements in pharmaceutical compounding are significantly influencing the compounding chemotherapy market in France. Innovations such as automated compounding systems and improved drug delivery methods are enhancing the precision and safety of chemotherapy preparations. These advancements not only streamline the compounding process but also reduce the risk of contamination and dosing errors. The compounding chemotherapy market is likely to benefit from these technologies, as they enable healthcare facilities to produce high-quality, patient-specific medications efficiently. Furthermore, the integration of artificial intelligence in drug formulation is expected to optimize treatment outcomes, potentially increasing the market's value by 20% over the next five years.

Increased Collaboration Among Healthcare Providers

Collaboration among healthcare providers is becoming increasingly vital in the compounding chemotherapy market in France. As multidisciplinary teams work together to develop comprehensive treatment plans, the demand for compounded chemotherapy solutions is likely to rise. This collaborative approach not only enhances patient care but also facilitates the sharing of knowledge and resources among healthcare professionals. The compounding chemotherapy market is benefiting from this trend, as it encourages the development of innovative therapies that meet the diverse needs of patients. The potential for improved patient outcomes through collaborative efforts may drive market growth, with projections indicating a 10% increase in market size by 2026.