Increasing Cancer Incidence

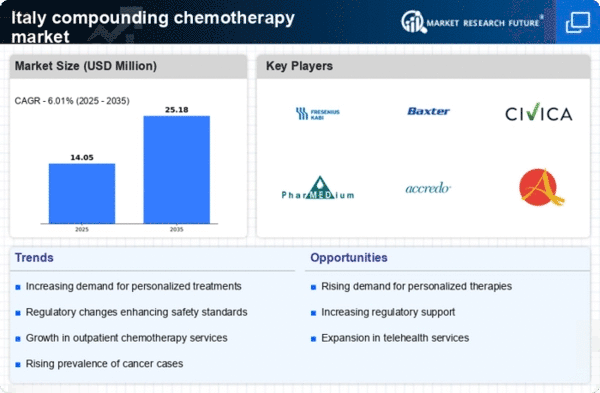

The rising incidence of cancer in Italy is a primary driver for the compounding chemotherapy market. According to recent statistics, cancer cases are projected to increase by approximately 1.5% annually, leading to a heightened demand for tailored chemotherapy solutions. This trend is particularly evident in regions with aging populations, where the prevalence of cancer is notably higher. As healthcare providers seek to offer personalized treatment regimens, the compounding chemotherapy market is likely to expand significantly. The need for customized formulations to address specific patient needs further emphasizes the importance of this market. Consequently, the compounding chemotherapy market is positioned to grow as healthcare systems adapt to the increasing burden of cancer, necessitating innovative and effective treatment options.

Advancements in Pharmaceutical Technology

Technological advancements in pharmaceutical compounding are reshaping the landscape of the compounding chemotherapy market. Innovations in drug formulation and delivery systems are enabling the creation of more effective and safer chemotherapy agents. For instance, the integration of automated compounding systems has improved accuracy and efficiency, reducing the risk of human error. Furthermore, the development of novel drug delivery methods, such as liposomal formulations, enhances the therapeutic efficacy of chemotherapy while minimizing side effects. As these technologies become more prevalent, the compounding chemotherapy market is expected to witness substantial growth. The ongoing investment in research and development within Italy's pharmaceutical sector indicates a commitment to improving patient outcomes through advanced compounding techniques.

Regulatory Support for Compounding Practices

Regulatory frameworks in Italy are evolving to support the compounding chemotherapy market, facilitating the safe and effective preparation of customized medications. Recent guidelines from health authorities emphasize the importance of quality assurance and patient safety in compounding practices. This regulatory support is crucial for compounding pharmacies, as it fosters an environment conducive to innovation and compliance. The establishment of clear standards for compounding practices not only enhances the credibility of the compounding chemotherapy market but also encourages more healthcare providers to utilize compounded medications. As regulations continue to adapt to the changing landscape of healthcare, the compounding chemotherapy market is likely to benefit from increased acceptance and utilization of compounded therapies.

Growing Demand for Customized Treatment Options

The shift towards personalized medicine is driving the demand for customized treatment options within the compounding chemotherapy market. Patients increasingly seek therapies tailored to their unique genetic profiles and specific cancer types. This trend is particularly pronounced in Italy, where healthcare providers are recognizing the importance of individualized treatment plans. The ability to compound chemotherapy agents that align with a patient's specific needs enhances treatment efficacy and minimizes adverse effects. As a result, the compounding chemotherapy market is experiencing a surge in demand for bespoke formulations. This growing preference for personalized therapies is likely to shape the future of cancer treatment in Italy, positioning the compounding chemotherapy market as a vital component of modern oncology.

Increased Collaboration Among Healthcare Providers

Collaboration among healthcare providers is emerging as a key driver for the compounding chemotherapy market. Interdisciplinary teams, including oncologists, pharmacists, and compounding specialists, are working together to develop comprehensive treatment plans that incorporate compounded medications. This collaborative approach enhances patient care by ensuring that chemotherapy regimens are tailored to individual needs. Additionally, partnerships between compounding pharmacies and healthcare institutions are fostering innovation in drug formulation and delivery. As these collaborations become more prevalent, the compounding chemotherapy market is likely to expand, driven by the collective expertise of healthcare professionals. This trend underscores the importance of teamwork in advancing cancer treatment and improving patient outcomes in Italy.