Supportive Government Policies

Supportive government policies in France are playing a pivotal role in shaping the celiac disease-treatment market. The French government has implemented various initiatives aimed at improving the quality of life for individuals with celiac disease, including subsidies for gluten-free products and funding for research into the condition. These policies are designed to alleviate the financial burden on patients and encourage adherence to gluten-free diets. As a result, the celiac disease-treatment market is likely to experience growth, as more individuals are empowered to seek appropriate treatments and dietary options. Furthermore, government support for awareness campaigns may enhance public understanding of celiac disease, further driving market demand.

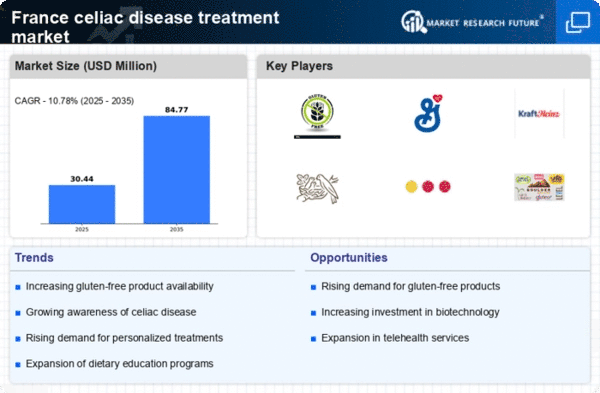

Growing Awareness of Celiac Disease

The increasing awareness of celiac disease among the French population is a crucial driver for the celiac disease-treatment market. Educational campaigns and initiatives by health organizations have led to a better understanding of the disease, its symptoms, and the importance of adhering to a strict gluten-free diet. This heightened awareness is reflected in the rising number of diagnoses, with estimates suggesting that approximately 1 in 100 individuals in France may be affected. Consequently, the demand for gluten-free products and treatments is expected to grow, propelling the celiac disease-treatment market forward. As more individuals seek medical advice and dietary guidance, healthcare providers are likely to expand their offerings, further stimulating market growth.

Advancements in Diagnostic Technologies

Recent advancements in diagnostic technologies are significantly impacting the celiac disease-treatment market. Improved testing methods, such as serological tests and genetic testing, have enhanced the accuracy and speed of celiac disease diagnoses. In France, the introduction of these innovative diagnostic tools has led to an increase in the identification of previously undiagnosed cases. This surge in diagnoses is likely to drive demand for treatment options, including specialized dietary plans and gluten-free products. As healthcare providers adopt these advanced technologies, the celiac disease-treatment market is expected to expand, catering to a growing population of diagnosed individuals seeking effective management solutions.

Rising Incidence of Autoimmune Disorders

The rising incidence of autoimmune disorders in France is a notable driver for the celiac disease-treatment market. Celiac disease, classified as an autoimmune condition, is increasingly recognized as part of a broader trend of autoimmune diseases affecting the population. Studies indicate that the prevalence of autoimmune disorders has been on the rise, which may correlate with environmental factors and lifestyle changes. This trend is likely to lead to a greater focus on celiac disease, prompting healthcare professionals to prioritize screening and treatment options. As awareness of the link between autoimmune disorders and celiac disease grows, the market for effective treatment solutions is expected to expand, catering to a larger patient base.

Increased Availability of Gluten-Free Products

The increased availability of gluten-free products in France is a significant driver for the celiac disease-treatment market. Retailers and manufacturers are responding to the growing demand for gluten-free options, resulting in a wider range of products being offered in supermarkets and specialty stores. This trend is supported by market data indicating that the gluten-free food market in France is projected to reach approximately €1 billion by 2026. As consumers become more health-conscious and seek gluten-free alternatives, the celiac disease-treatment market is likely to benefit from this expansion. The availability of diverse gluten-free products not only supports those diagnosed with celiac disease but also attracts a broader audience interested in gluten-free diets.