Advancements in Biotechnology

Advancements in biotechnology are significantly influencing the France Active Pharmaceutical Ingredient For Cancer Market. The integration of biopharmaceuticals into cancer treatment has led to the development of targeted therapies and personalized medicine, which are increasingly becoming the standard of care. French biotech firms are at the forefront of this innovation, focusing on the creation of novel APIs derived from biological sources. The market for biopharmaceuticals in France is expected to grow, with projections indicating a compound annual growth rate of over 10% in the coming years. This growth is likely to drive demand for specialized APIs that cater to these advanced therapies, thereby enhancing the overall landscape of the France Active Pharmaceutical Ingredient For Cancer Market.

Focus on Personalized Medicine

The focus on personalized medicine is reshaping the France Active Pharmaceutical Ingredient For Cancer Market. As the understanding of cancer biology advances, there is a growing emphasis on tailoring treatments to individual patient profiles. This shift necessitates the development of specific APIs that can target unique genetic markers associated with different cancer types. French pharmaceutical companies are increasingly investing in research to identify and develop these personalized therapies, which are expected to enhance treatment outcomes. The market for personalized medicine in France is projected to expand, with estimates suggesting a growth rate of around 8% annually. This trend is likely to drive innovation in the API sector, as the France Active Pharmaceutical Ingredient For Cancer Market adapts to meet the evolving needs of cancer treatment.

Rising Demand for Generic Drugs

The rising demand for generic drugs in France is a significant factor impacting the France Active Pharmaceutical Ingredient For Cancer Market. As patents for several cancer medications expire, there is a growing shift towards the use of generic alternatives, which are often more affordable for patients and healthcare systems. This trend is expected to increase the volume of APIs required for generic drug production, as manufacturers seek to capitalize on the cost-saving potential of these medications. The French healthcare system, which emphasizes cost-effectiveness, is likely to further drive this demand. Consequently, the France Active Pharmaceutical Ingredient For Cancer Market may witness a surge in the production of generic APIs, fostering competition and innovation within the sector.

Government Initiatives and Funding

Government initiatives aimed at combating cancer in France play a crucial role in shaping the France Active Pharmaceutical Ingredient For Cancer Market. The French government has implemented various programs to support cancer research and treatment, including substantial funding for public and private research institutions. For instance, the National Cancer Plan outlines strategic objectives to improve cancer care and promote innovation in drug development. This funding not only facilitates the discovery of new APIs but also encourages collaboration between academia and industry. As a result, the France Active Pharmaceutical Ingredient For Cancer Market is likely to benefit from enhanced research capabilities and accelerated drug development timelines, ultimately leading to more effective cancer therapies.

Growing Cancer Incidence in France

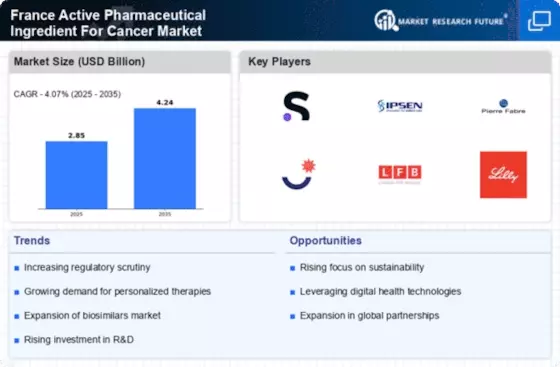

The rising incidence of cancer in France is a pivotal driver for the France Active Pharmaceutical Ingredient For Cancer Market. According to recent statistics, cancer cases in France are projected to increase, with estimates suggesting that by 2025, nearly 400,000 new cases will be diagnosed annually. This alarming trend necessitates the development and production of effective active pharmaceutical ingredients (APIs) to combat various cancer types. The increasing patient population drives demand for innovative therapies, thereby propelling the growth of the API market. Pharmaceutical companies are likely to invest in research and development to create novel APIs tailored to specific cancer types, enhancing treatment efficacy. Consequently, the France Active Pharmaceutical Ingredient For Cancer Market is expected to expand significantly as stakeholders respond to the urgent need for effective cancer treatments.