Advancements in Biotechnology

The GCC Active Pharmaceutical Ingredient For Cancer Market is significantly influenced by advancements in biotechnology. Innovations in biopharmaceuticals, including monoclonal antibodies and gene therapies, are reshaping cancer treatment paradigms. The GCC region has seen a surge in biotech firms focusing on developing novel APIs that target specific cancer pathways. For instance, the introduction of biosimilars has the potential to reduce treatment costs while maintaining efficacy. As these biotechnological advancements continue to evolve, they are expected to enhance the availability of effective cancer treatments in the GCC, thereby expanding the market for active pharmaceutical ingredients. The integration of biotechnology into cancer treatment strategies is likely to foster collaboration between research institutions and pharmaceutical companies, further propelling the GCC Active Pharmaceutical Ingredient For Cancer Market.

Rising Awareness and Education on Cancer

The GCC Active Pharmaceutical Ingredient For Cancer Market is positively impacted by increasing awareness and education regarding cancer prevention and treatment. Public health campaigns and educational initiatives are being launched across GCC countries to inform citizens about cancer risks and the importance of early detection. As awareness grows, there is a corresponding increase in demand for effective cancer treatments, including active pharmaceutical ingredients. For example, initiatives in Qatar and Kuwait have focused on educating the public about the benefits of targeted therapies and the availability of new APIs. This heightened awareness is likely to drive patient engagement and encourage healthcare providers to prescribe innovative cancer treatments, thereby expanding the GCC Active Pharmaceutical Ingredient For Cancer Market.

Increasing Cancer Incidence in GCC Region

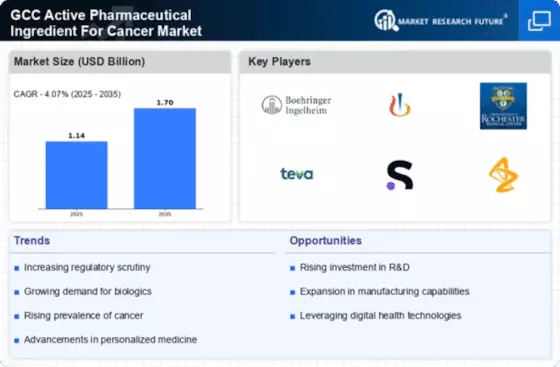

The GCC Active Pharmaceutical Ingredient For Cancer Market is experiencing growth due to the rising incidence of cancer across the region. According to health statistics, cancer cases in GCC countries have been on the rise, with projections indicating that by 2025, the number of new cancer cases could reach over 200,000 annually. This alarming trend necessitates the development and availability of effective active pharmaceutical ingredients (APIs) for cancer treatment. As healthcare systems in the GCC strive to address this growing burden, there is a heightened demand for innovative therapies and APIs that can cater to various cancer types. Consequently, pharmaceutical companies are increasingly investing in research and development to create targeted therapies, thereby driving the GCC Active Pharmaceutical Ingredient For Cancer Market forward.

Regulatory Support for Local API Production

The GCC Active Pharmaceutical Ingredient For Cancer Market is witnessing a favorable regulatory environment that supports local API production. Governments in the region are implementing policies aimed at enhancing self-sufficiency in pharmaceutical manufacturing. For instance, the UAE has introduced initiatives to streamline the regulatory process for local manufacturers, encouraging them to produce APIs domestically. This shift not only aims to reduce reliance on foreign suppliers but also enhances the quality and availability of cancer treatment options. As regulatory frameworks evolve to support local production, pharmaceutical companies are likely to invest in the development of APIs tailored to the needs of the GCC market. This regulatory support is expected to play a crucial role in shaping the future landscape of the GCC Active Pharmaceutical Ingredient For Cancer Market.

Growing Investment in Healthcare Infrastructure

The GCC Active Pharmaceutical Ingredient For Cancer Market is benefiting from substantial investments in healthcare infrastructure across the region. Governments in GCC countries are prioritizing healthcare development, with budgets allocated for enhancing medical facilities and research capabilities. For example, Saudi Arabia's Vision 2030 initiative emphasizes the importance of healthcare innovation and aims to improve cancer care services. This investment not only facilitates the establishment of advanced treatment centers but also encourages local production of APIs, reducing dependency on imports. As healthcare infrastructure improves, the accessibility of cancer treatments is expected to increase, thereby driving demand for active pharmaceutical ingredients in the GCC region. The ongoing development of healthcare facilities is likely to create a conducive environment for pharmaceutical companies to thrive.