Rising Energy Demand

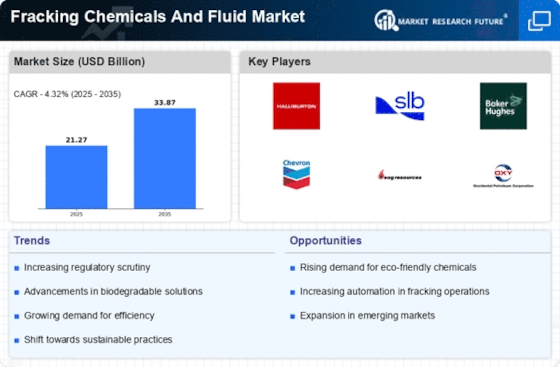

The Fracking Chemicals And Fluid Market is poised for growth driven by the rising demand for energy across various sectors. As populations expand and economies develop, the need for reliable energy sources continues to escalate. This demand is particularly pronounced in regions where traditional energy sources are becoming increasingly scarce. The International Energy Agency has indicated that unconventional oil and gas resources, primarily accessed through fracking, will play a crucial role in meeting future energy needs. Consequently, the demand for fracking chemicals and fluids is expected to rise as operators seek to maximize extraction from these resources. This trend suggests a robust market environment for fracking chemicals, as companies strive to meet the energy requirements of an ever-growing global population.

Growing Focus on Sustainable Practices

The Fracking Chemicals And Fluid Market is increasingly characterized by a growing focus on sustainable practices. Stakeholders are becoming more aware of the environmental impacts associated with hydraulic fracturing, prompting a shift towards more sustainable chemical solutions. Companies are investing in the development of eco-friendly fracking fluids that minimize environmental risks while maintaining operational efficiency. This trend is supported by consumer demand for responsible energy production and the need for companies to enhance their corporate social responsibility profiles. As sustainability becomes a central theme in the energy sector, the Fracking Chemicals And Fluid Market is likely to evolve, with an emphasis on innovative solutions that align with environmental stewardship.

Increased Investment in Unconventional Resources

The Fracking Chemicals And Fluid Market is benefiting from increased investment in unconventional resources, particularly shale gas and tight oil formations. Investors are recognizing the potential of these resources to provide substantial returns, leading to a surge in funding for exploration and production activities. According to recent estimates, investments in shale plays have reached unprecedented levels, with billions allocated to enhance extraction capabilities. This influx of capital is likely to drive demand for specialized fracking chemicals and fluids, as operators require advanced solutions to optimize their operations. Moreover, as more companies enter the market, competition is expected to intensify, further propelling innovation and development within the Fracking Chemicals And Fluid Market.

Regulatory Developments and Compliance Requirements

The Fracking Chemicals And Fluid Market is increasingly influenced by regulatory developments and compliance requirements. Governments are implementing stricter regulations concerning environmental protection and safety standards, which necessitate the use of safer and more effective fracking chemicals. This regulatory landscape is compelling companies to invest in research and development to create environmentally friendly alternatives. As a result, the market is witnessing a shift towards the formulation of biodegradable and non-toxic chemicals, which not only comply with regulations but also appeal to environmentally conscious consumers. The ongoing evolution of regulatory frameworks is likely to shape the future of the Fracking Chemicals And Fluid Market, as companies adapt to meet these new standards.

Technological Advancements in Extraction Techniques

The Fracking Chemicals And Fluid Market is experiencing a notable shift due to technological advancements in extraction techniques. Innovations such as improved hydraulic fracturing methods and enhanced fluid formulations are driving efficiency and effectiveness in resource extraction. For instance, the introduction of advanced proppants and surfactants has been shown to increase the yield of oil and gas wells significantly. As a result, operators are increasingly adopting these technologies to optimize production rates and reduce operational costs. The market for fracking chemicals is projected to grow as companies seek to leverage these advancements to enhance their competitive edge. Furthermore, the integration of data analytics and real-time monitoring systems is likely to improve decision-making processes, thereby fostering a more efficient and sustainable approach within the Fracking Chemicals And Fluid Market.