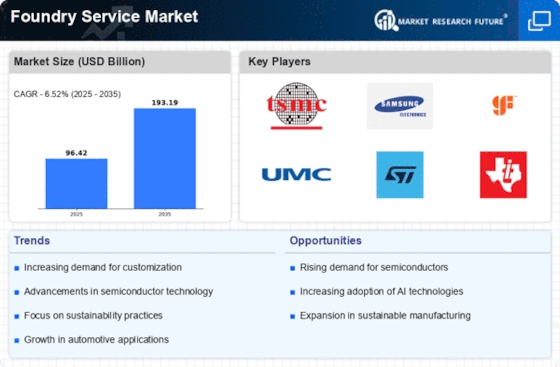

Rising Demand for Semiconductors

The Foundry Service Market is experiencing a notable surge in demand for semiconductors, driven by the proliferation of electronic devices and the increasing complexity of integrated circuits. As industries such as automotive, telecommunications, and consumer electronics expand, the need for advanced semiconductor solutions becomes paramount. According to recent data, the semiconductor market is projected to reach a valuation of over 500 billion dollars by 2025, indicating a robust growth trajectory. This demand compels foundry service providers to enhance their manufacturing capabilities and invest in cutting-edge technologies to meet the evolving requirements of their clients. Consequently, the Foundry Service Market is likely to witness significant investments aimed at scaling production and improving efficiency, thereby positioning itself as a critical player in the broader technology landscape.

Increased Focus on Miniaturization

Miniaturization remains a pivotal trend influencing the Foundry Service Market, as manufacturers strive to create smaller, more efficient electronic components. The demand for compact devices, particularly in consumer electronics and medical technology, necessitates advanced fabrication techniques that can produce high-density integrated circuits. This trend is supported by data indicating that the market for miniaturized electronics is projected to grow at a compound annual growth rate of over 10% through 2025. Foundry service providers are thus compelled to invest in innovative manufacturing processes and technologies that facilitate the production of smaller components without compromising performance. This focus on miniaturization not only enhances product functionality but also aligns with consumer preferences for sleek and portable devices, further driving growth within the Foundry Service Market.

Emergence of AI and IoT Applications

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into various sectors is reshaping the landscape of the Foundry Service Market. As businesses increasingly adopt AI-driven solutions and IoT devices, the demand for specialized semiconductor components rises. These components are essential for enabling smart functionalities in devices ranging from home appliances to industrial machinery. The market for AI and IoT is expected to grow exponentially, with estimates suggesting a combined market size exceeding 1 trillion dollars by 2025. This growth presents a substantial opportunity for foundry service providers to innovate and develop tailored solutions that cater to the specific needs of AI and IoT applications, thereby enhancing their competitive edge within the Foundry Service Market.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are becoming increasingly prevalent within the Foundry Service Market, as companies seek to leverage complementary strengths to enhance their service offerings. By forming alliances with technology firms, research institutions, and other stakeholders, foundry service providers can access new markets, share resources, and accelerate innovation. These collaborations often lead to the development of advanced manufacturing techniques and the introduction of novel semiconductor products. Recent trends indicate that partnerships focused on research and development are likely to increase, as companies aim to stay competitive in a rapidly evolving market. This collaborative approach not only fosters innovation but also strengthens the overall ecosystem of the Foundry Service Market, enabling participants to respond more effectively to changing market demands.

Regulatory Compliance and Quality Standards

The Foundry Service Market is increasingly influenced by stringent regulatory compliance and quality standards, which are essential for ensuring the reliability and safety of semiconductor products. As industries such as automotive and healthcare adopt more rigorous standards, foundry service providers must align their operations with these requirements to maintain market access. Compliance with international quality standards, such as ISO and IPC, is becoming a prerequisite for success in the foundry sector. This focus on quality not only enhances product reliability but also builds consumer trust, which is vital in competitive markets. Data suggests that companies prioritizing compliance and quality assurance are likely to experience improved market positioning and customer loyalty, thereby reinforcing the importance of these factors within the Foundry Service Market.