Regulatory Compliance

Regulatory compliance is a critical driver in the Food Service Disposable Market. Governments worldwide are implementing stricter regulations regarding the use of plastics and non-biodegradable materials. These regulations are pushing businesses to seek alternatives that comply with environmental standards. For instance, many regions are banning single-use plastics, prompting a shift towards biodegradable and compostable options. This regulatory landscape creates both challenges and opportunities for manufacturers in the Food Service Disposable Market. Companies that proactively adapt to these regulations can gain a competitive edge, while those that fail to comply may face penalties and loss of market share. Thus, navigating the regulatory environment is essential for sustained growth.

Sustainability Initiatives

The Food Service Disposable Market is increasingly influenced by sustainability initiatives. Consumers and businesses alike are becoming more environmentally conscious, leading to a demand for eco-friendly disposable products. This shift is reflected in the growing market for biodegradable and compostable materials, which are projected to reach a valuation of approximately 10 billion dollars by 2026. Companies are investing in sustainable practices, such as using recycled materials and reducing plastic waste. This trend not only aligns with consumer preferences but also helps businesses comply with stringent regulations aimed at reducing environmental impact. As a result, the Food Service Disposable Market is likely to see a significant transformation, with sustainability becoming a core component of product development and marketing strategies.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Food Service Disposable Market. Innovations in material science have led to the development of new types of disposables that are not only functional but also environmentally friendly. For instance, advancements in bioplastics and plant-based materials are enabling manufacturers to create products that decompose more efficiently. Furthermore, automation in production processes is enhancing efficiency and reducing costs, which is crucial in a competitive market. The integration of smart technologies, such as QR codes for tracking and inventory management, is also emerging. These advancements suggest that the Food Service Disposable Market is on the brink of a technological revolution that could redefine operational standards and consumer expectations.

Changing Consumer Preferences

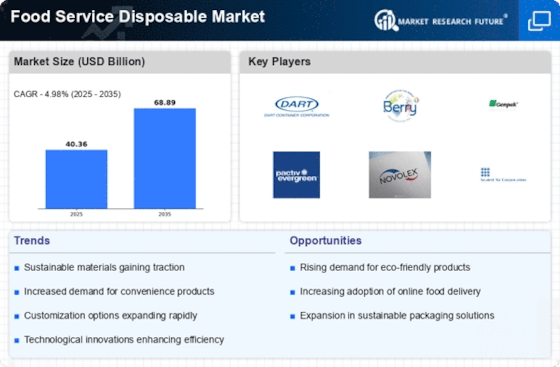

Changing consumer preferences are significantly impacting the Food Service Disposable Market. There is a noticeable shift towards convenience, with consumers increasingly favoring single-use products that offer ease of use and time savings. This trend is particularly evident in the rise of takeout and delivery services, which have become a staple in many dining experiences. According to recent data, the demand for disposable food containers and utensils has surged, with a projected growth rate of 5% annually. This shift indicates that the Food Service Disposable Market must adapt to meet evolving consumer needs, focusing on products that enhance convenience while maintaining quality and safety.

Market Expansion Opportunities

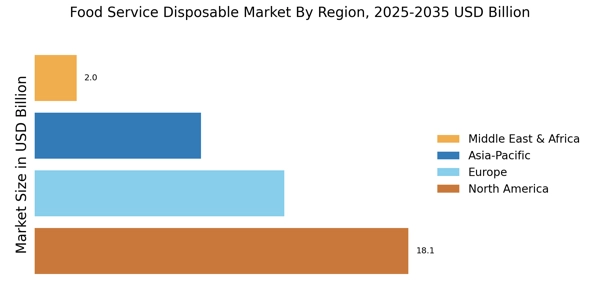

Market expansion opportunities are emerging as a significant driver in the Food Service Disposable Market. The increasing number of food service establishments, including restaurants, cafes, and food trucks, is creating a higher demand for disposable products. Additionally, the rise of e-commerce and online food delivery services is further fueling this demand. According to industry reports, the food service sector is expected to grow by 4% annually, which will likely translate into increased sales for disposable products. This expansion presents a lucrative opportunity for manufacturers to innovate and diversify their product offerings. By tapping into new markets and consumer segments, the Food Service Disposable Market can enhance its growth trajectory and profitability.

Leave a Comment