Increasing Regulatory Compliance

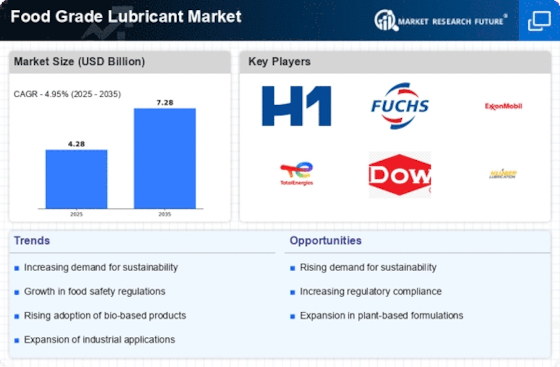

The Food Grade Lubricant Market is experiencing a surge in demand due to stringent regulatory compliance requirements. Various food safety regulations necessitate the use of lubricants that are safe for food contact. This has led manufacturers to innovate and develop products that meet these standards. For instance, the U.S. Food and Drug Administration (FDA) has established guidelines that lubricants must adhere to, which has prompted companies to invest in research and development. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years, driven by the need for compliance with these regulations.

Growth in Food Processing Industry

The Food Grade Lubricant Market is closely linked to the expansion of the food processing sector. As the demand for processed food continues to rise, the need for effective lubrication solutions in food manufacturing processes becomes increasingly critical. This sector is projected to grow significantly, with estimates suggesting a market size increase of over 10% in the coming years. Consequently, food processors are seeking lubricants that not only enhance machinery efficiency but also comply with safety standards. This trend is likely to bolster the demand for food grade lubricants, as manufacturers strive to maintain operational efficiency while adhering to safety regulations.

Consumer Awareness and Health Consciousness

The Food Grade Lubricant Market is witnessing a shift in consumer preferences towards health-conscious products. As consumers become more aware of the ingredients in their food, there is a growing demand for non-toxic and safe lubricants in food production. This trend is influencing manufacturers to prioritize the development of food grade lubricants that are free from harmful chemicals. Market data indicates that the demand for such products is expected to rise, with a projected increase of 7% in the next few years. This heightened consumer awareness is driving companies to innovate and reformulate their products to meet these evolving expectations.

Sustainability Initiatives in Food Production

The Food Grade Lubricant Market is increasingly influenced by sustainability initiatives within the food production sector. As companies strive to reduce their environmental footprint, there is a growing emphasis on using biodegradable and eco-friendly lubricants. This shift is not only driven by regulatory pressures but also by consumer demand for sustainable practices. Market Research Future suggests that the demand for environmentally friendly food grade lubricants is expected to grow by approximately 8% in the next few years. This trend indicates a significant opportunity for manufacturers to innovate and develop products that align with sustainability goals while ensuring compliance with food safety standards.

Technological Advancements in Lubrication Solutions

The Food Grade Lubricant Market is benefiting from technological advancements that enhance lubrication solutions. Innovations in formulation and application techniques are leading to the development of high-performance lubricants that offer superior protection and efficiency. For example, the introduction of synthetic food grade lubricants has improved performance in extreme conditions, thereby extending equipment life and reducing maintenance costs. This trend is likely to continue, with market analysts predicting a growth rate of around 6% in the coming years as manufacturers adopt these advanced technologies to meet the demands of modern food processing.