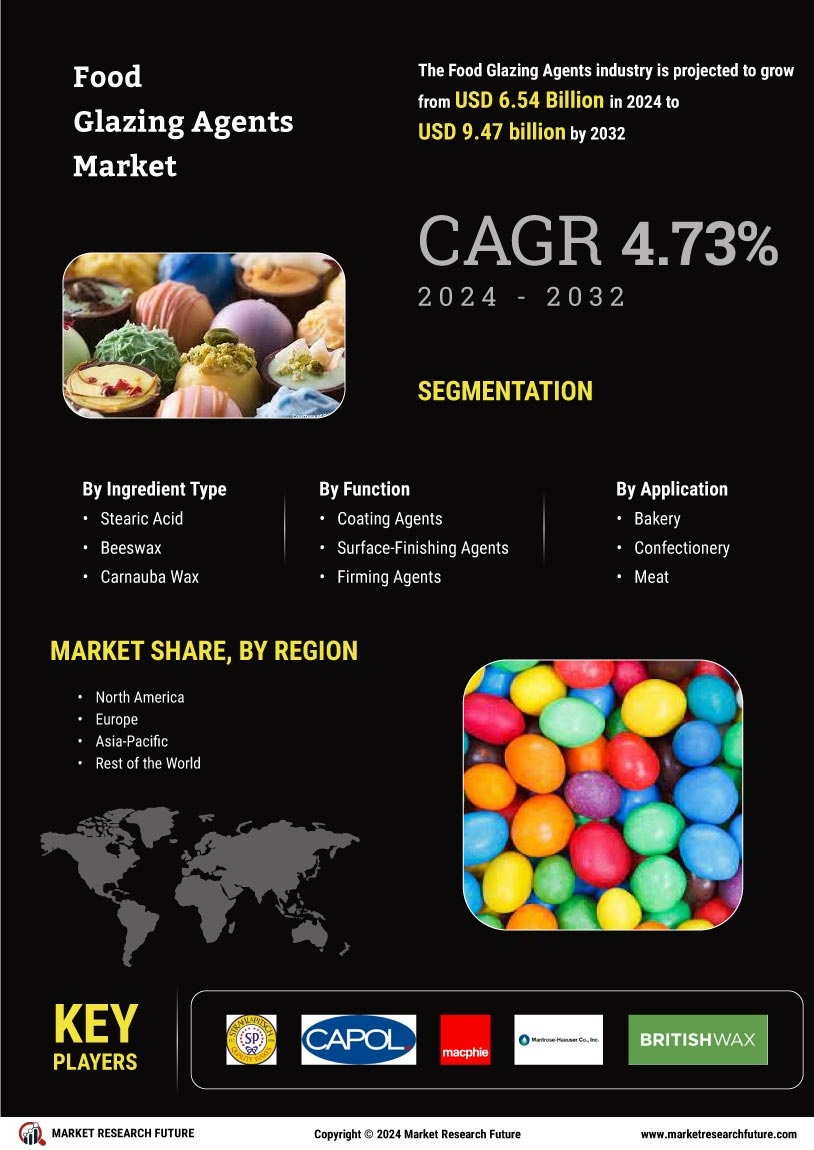

Rising Health Consciousness

The increasing health consciousness among consumers is reshaping the Food Glazing Agents Market. As individuals become more aware of the nutritional content of their food, there is a growing demand for healthier alternatives to traditional glazing agents. This shift is prompting manufacturers to explore natural and organic glazing options that align with consumer preferences for clean label products. Data indicates that the market for natural food additives, including glazing agents, is expected to grow at a rate of 6% per year. This trend suggests that the Food Glazing Agents Market must adapt to meet the needs of health-conscious consumers, potentially leading to the development of innovative products that prioritize both aesthetics and nutritional value.

Innovation in Food Technology

Innovation within the food technology sector is significantly influencing the Food Glazing Agents Market. Advances in food processing techniques and the development of new glazing formulations are enabling manufacturers to create products that meet evolving consumer preferences. For instance, the introduction of plant-based and organic glazing agents aligns with the growing trend towards healthier eating. Furthermore, technological advancements in food preservation methods are enhancing the effectiveness of glazing agents, thereby extending shelf life and improving product quality. The market for food glazing agents is expected to witness a growth rate of around 5% annually, driven by these innovations. As food manufacturers continue to invest in research and development, the Food Glazing Agents Market is likely to see a diversification of products that cater to health-conscious consumers.

Expansion of the Bakery Sector

The expansion of the bakery sector is a significant driver for the Food Glazing Agents Market. With the increasing popularity of artisanal and specialty baked goods, there is a heightened demand for glazing agents that enhance the visual appeal and texture of these products. The bakery industry is projected to grow at a compound annual growth rate of approximately 4% in the coming years, driven by consumer preferences for high-quality, visually appealing baked items. Glazing agents play a vital role in this sector, providing a glossy finish and improving the overall presentation of baked goods. As the bakery market continues to flourish, the Food Glazing Agents Market is likely to experience substantial growth, as manufacturers seek to meet the demands of both commercial and artisanal bakers.

Growing Demand for Processed Foods

The Food Glazing Agents Market is experiencing a notable surge in demand for processed foods. As consumers increasingly seek convenience, the market for ready-to-eat and packaged food products expands. This trend is reflected in the rising sales of frozen meals, snacks, and confectionery items, which often utilize glazing agents to enhance appearance and shelf life. According to recent data, the processed food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is likely to drive the demand for food glazing agents, as manufacturers aim to improve product quality and consumer appeal. Consequently, the Food Glazing Agents Market is poised to benefit from this shift towards processed food consumption, as glazing agents play a crucial role in maintaining product freshness and visual appeal.

Increased Focus on Aesthetics in Food Presentation

The heightened focus on aesthetics in food presentation is influencing the Food Glazing Agents Market. As social media platforms promote visually appealing food, consumers are increasingly drawn to products that are not only tasty but also attractive. This trend is particularly evident in the confectionery and dessert segments, where glazing agents are essential for achieving the desired look and texture. Market analysis suggests that the demand for aesthetically pleasing food products is driving a growth rate of approximately 5% in the food glazing sector. Consequently, manufacturers are investing in high-quality glazing agents that enhance the visual appeal of their offerings. The Food Glazing Agents Market is thus positioned to thrive as it caters to the growing consumer desire for visually stunning food products.