Aging Population

The Global Natural Functional Food Market Industry is significantly influenced by the aging population, which tends to prioritize health and wellness. As the demographic of older adults expands, there is a corresponding increase in demand for functional foods that address age-related health issues. Products that promote cognitive function, heart health, and digestive wellness are particularly sought after. This demographic shift is expected to contribute to the market's growth, with projections indicating a market size of 36.0 USD Billion by 2035. The aging population's focus on preventive health measures is likely to drive innovation and diversification within the functional food sector.

Rising Health Consciousness

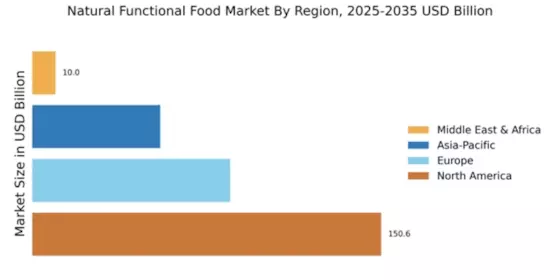

The Global Natural Functional Food Market Industry experiences a notable surge in demand driven by increasing health consciousness among consumers. Individuals are becoming more aware of the nutritional benefits of functional foods, which are perceived to enhance health and well-being. This trend is reflected in the projected market size of 22.9 USD Billion in 2024, indicating a robust interest in products that offer health benefits beyond basic nutrition. Consumers are actively seeking foods fortified with vitamins, minerals, and probiotics, which are believed to support immune function and overall health. As awareness grows, the industry is likely to expand further, catering to a more health-oriented consumer base.

Growing Demand for Plant-Based Products

The Global Natural Functional Food Market Industry is witnessing a growing demand for plant-based products, driven by shifting consumer preferences towards healthier and more sustainable food options. As more individuals adopt vegetarian and vegan diets, the market for plant-based functional foods is expanding. These products are often perceived as healthier alternatives, offering various health benefits such as improved digestion and reduced risk of chronic diseases. The rise in plant-based diets is expected to contribute to the market's growth, with a projected CAGR of 4.18% from 2025 to 2035. This trend reflects a broader societal shift towards sustainability and health-conscious eating.

Technological Advancements in Food Processing

Technological advancements in food processing are playing a crucial role in shaping the Global Natural Functional Food Market Industry. Innovations such as improved extraction methods and enhanced preservation techniques allow for the development of functional foods that retain their nutritional value while offering extended shelf life. These advancements facilitate the incorporation of various bioactive compounds into food products, enhancing their health benefits. As a result, consumers are presented with a wider array of options that meet their health needs. The ongoing evolution of food technology is likely to support the market's growth trajectory, aligning with the increasing consumer demand for high-quality functional foods.

Increased Investment in Research and Development

Increased investment in research and development is a key driver of the Global Natural Functional Food Market Industry. Companies are dedicating resources to explore new functional ingredients and their health benefits, leading to the introduction of innovative products. This focus on R&D not only enhances product offerings but also helps in meeting the evolving consumer demands for transparency and efficacy in functional foods. As businesses strive to differentiate themselves in a competitive market, the emphasis on scientific validation of health claims is likely to foster consumer trust and drive market growth.