Regulatory Compliance

Regulatory compliance is becoming an increasingly important driver in the Wax Emulsion Market. As governments worldwide implement stricter regulations regarding chemical safety and environmental impact, manufacturers are compelled to adapt their formulations accordingly. This has led to a growing demand for wax emulsions that comply with these regulations, particularly in industries such as food packaging and personal care. Companies are investing in the development of compliant products that not only meet safety standards but also appeal to environmentally conscious consumers. The market is likely to see a shift towards more transparent labeling and the use of safer ingredients, which could enhance consumer trust and drive sales. As regulatory frameworks evolve, the Wax Emulsion Market must remain agile to meet these changing demands.

Technological Innovations

Technological innovations play a crucial role in shaping the Wax Emulsion Market. Advances in formulation technologies and production processes have led to the development of high-performance wax emulsions that cater to diverse applications. For instance, the introduction of advanced emulsification techniques has improved the stability and performance of wax emulsions, making them suitable for use in coatings, inks, and personal care products. The market is witnessing a surge in demand for specialty wax emulsions that offer enhanced properties such as water resistance and durability. This trend is expected to propel the market forward, with estimates suggesting a market value increase to over USD 1 billion by 2027. As manufacturers continue to innovate, the Wax Emulsion Market is likely to experience significant growth driven by these technological advancements.

Sustainability Initiatives

The Wax Emulsion Market is increasingly influenced by sustainability initiatives. As consumers and manufacturers alike prioritize eco-friendly products, the demand for wax emulsions derived from renewable resources is on the rise. This shift is evident in various sectors, including coatings, adhesives, and textiles, where sustainable formulations are becoming a standard. The market is projected to grow at a compound annual growth rate of approximately 5% over the next few years, driven by the need for environmentally responsible solutions. Companies are investing in research and development to create bio-based wax emulsions that meet stringent environmental regulations. This trend not only enhances brand reputation but also aligns with global efforts to reduce carbon footprints, making sustainability a pivotal driver in the Wax Emulsion Market.

Diverse End-Use Applications

The Wax Emulsion Market benefits from a wide array of end-use applications, which significantly contributes to its growth. Industries such as automotive, construction, and packaging are increasingly adopting wax emulsions for their unique properties. In the automotive sector, wax emulsions are utilized for surface coatings that enhance durability and aesthetic appeal. Similarly, in construction, these emulsions are employed in sealants and adhesives, providing moisture resistance and improved adhesion. The packaging industry also leverages wax emulsions for coatings that enhance barrier properties. This diversification across multiple sectors is expected to drive the market's expansion, with projections indicating a steady increase in demand. As industries continue to explore the benefits of wax emulsions, the Wax Emulsion Market is poised for sustained growth.

Rising Demand in Emerging Markets

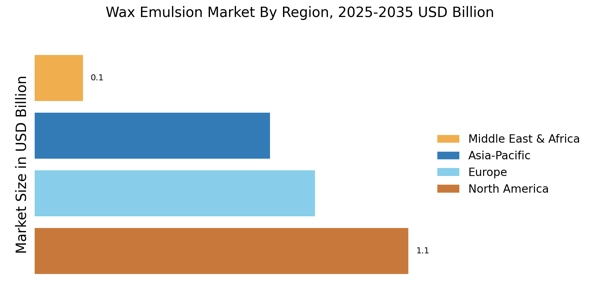

The Wax Emulsion Market is experiencing a notable increase in demand from emerging markets. As economies in regions such as Asia-Pacific and Latin America continue to develop, there is a growing need for various industrial applications that utilize wax emulsions. The construction and automotive sectors in these regions are expanding rapidly, leading to increased consumption of wax emulsions for coatings, adhesives, and sealants. Furthermore, the rise of the middle class in these markets is driving demand for consumer goods that incorporate wax emulsions, such as personal care products and packaging materials. This trend suggests a promising growth trajectory for the Wax Emulsion Market, with potential market expansion opportunities in these developing regions.