Research Methodology on Food Emulsifiers Market

Introduction

The purpose of this research study is to investigate the current state and future potential developments of the food emulsifiers market. To accurately measure the elements involved in this market and gain reliable data used for analysis, an elaborate methodology was used to accurately investigate the global market. Combining primary and secondary data collection sources, a complete and comprehensive overview of the food emulsifiers market was generated.

Primary Sources

Primary sources served to provide a detailed inside view of the food emulsifiers market during the entire scope of research, from first emerging conceptions through extensive data gathering and analysis. Primary sources of research included interviews and communications with experts in the industry, including chemical and food scientists, manufacturers, suppliers, distributors, retailers, and other related parties. These conversations relied heavily on questionnaires that were both of closed and open-ended varieties, providing qualitative and quantitative data. Depending on the source, some surveys were in person, while others were conducted via mail or the telephone. The primary sources of data allowed for the appropriate and reliable collection of information related to the production, consumption, sale, demand, and pricing of food emulsifiers.

Secondary Sources

Secondary research sources were also used to collect relevant data regarding the food emulsifiers market. These include government websites, databases from educational institutions, press releases, primary and secondary publications, and existing research published in accessible sources. By combining primary and secondary sources of data, Market Research Future (MRFR) was able to gain both a fresh perspective on the market and coordinate obtained data to provide a reliable report of the current state and future projections of food emulsifiers.

Elements of Research Study

The elements used to construct the market research study focused on three main aspects of the food emulsifiers market. The first element used to evaluate the market was the drivers and restraints, which focused on understanding the motivations behind the changes in the market as well as the key components that hampered the expansion of this market. This element also looked at a range of factors, including economic trends, health-related factors, consumer demand, production and distribution costs, prices and value of the product, and environmental impacts.

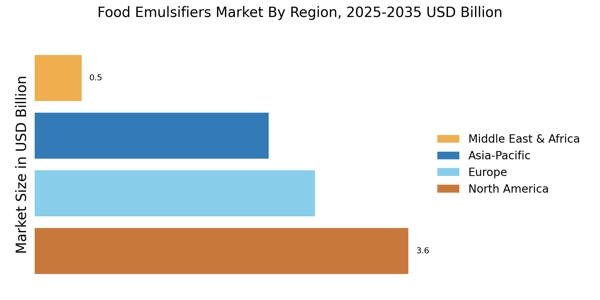

The second element of the research was the market segmentation. This element was used to break down the market in terms of geography, grade, emulsifier type, source type, and application. These elements serve to identify market specifics, such as whom the main consumers of the product were, differentiating between the regional markets, understanding changes in value over time in different grade types, differentiating the various emulsifier types and their respective characteristics, understanding the various sources of food emulsifiers and application of the different types. This provides a good overview of the market and can be used to make market-specific predictions for the future.

The final element of the research was the competitive landscape, where a detailed overview of the competition between market players, ranging from large-scale companies to small startups, was provided. This market segment focused on the key industry players and their respective strategies, focusing on both strategy implementation and marketing campaigns. By assessing the impact of the strategies on the current market, reliable predictions of the market potential moving forward can be obtained.

Conclusion

This research study provided a comprehensive evaluation of the food emulsifiers market. Understanding key points such as the drivers and restraints in the market, market segmentation, and the competitive landscape produced an accurate market report that can successfully be used to determine the current state of food emulsifiers and make predictions for future potential developments in this market space.