Health Benefits of Lecithin

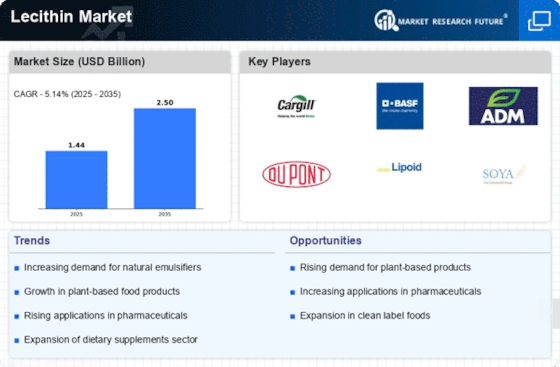

The rising awareness of health benefits associated with lecithin is a primary driver in the Lecithin Market. Lecithin Market is recognized for its potential to support brain health, improve cholesterol levels, and enhance liver function. As consumers increasingly prioritize health and wellness, the demand for lecithin as a dietary supplement has surged. According to recent data, the dietary supplement segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates a robust market for lecithin products, particularly in the health-conscious demographic. Furthermore, the incorporation of lecithin in functional foods and beverages is likely to expand, as manufacturers seek to meet consumer preferences for healthier options. Thus, the health benefits associated with lecithin are expected to significantly influence the Lecithin Market.

Rising Demand in Pharmaceutical Sector

The pharmaceutical sector's growing demand for lecithin is emerging as a significant driver in the Lecithin Market. Lecithin Market is utilized in drug formulations for its emulsifying properties, which enhance the bioavailability of active ingredients. The pharmaceutical industry is expected to witness a steady growth rate, with lecithin's role in drug delivery systems becoming increasingly prominent. Recent estimates indicate that the pharmaceutical segment could account for approximately 25% of the overall lecithin market by 2025. This trend is likely fueled by the ongoing research and development efforts aimed at improving drug formulations, particularly in the area of lipid-based delivery systems. Consequently, the rising demand for lecithin in pharmaceuticals is anticipated to contribute positively to the Lecithin Market.

Versatile Applications in Food Industry

The versatility of lecithin in the food industry serves as a crucial driver for the Lecithin Market. Lecithin Market is widely utilized as an emulsifier, stabilizer, and texturizer in various food products, including chocolates, baked goods, and dressings. The food sector is projected to account for a substantial share of the lecithin market, with estimates suggesting it could represent over 40% of total demand by 2026. This is largely due to the increasing consumer preference for clean-label products, which has prompted food manufacturers to seek natural emulsifiers like lecithin. Additionally, the trend towards plant-based diets has further bolstered the demand for lecithin derived from soy and sunflower sources. As such, the diverse applications of lecithin in the food industry are likely to propel growth within the Lecithin Market.

Increasing Use in Personal Care Products

The increasing incorporation of lecithin in personal care products is emerging as a notable driver in the Lecithin Market. Lecithin Market is valued for its moisturizing and emulsifying properties, making it a popular ingredient in creams, lotions, and hair care products. The personal care sector is projected to experience steady growth, with lecithin's share in formulations expected to rise as consumers seek products with natural ingredients. Recent market analyses suggest that the personal care segment could represent around 15% of the total lecithin market by 2026. This trend is likely influenced by the broader movement towards clean beauty and the demand for products free from synthetic additives. Therefore, the increasing use of lecithin in personal care products is anticipated to bolster the Lecithin Market.

Technological Advancements in Production

Technological advancements in lecithin production are playing a pivotal role in shaping the Lecithin Market. Innovations in extraction and processing techniques have led to higher yields and improved quality of lecithin products. For instance, the adoption of cold-press extraction methods is gaining traction, as it preserves the nutritional properties of lecithin while minimizing chemical use. This shift towards more sustainable production practices aligns with consumer preferences for natural and organic products. Furthermore, advancements in refining processes are enabling manufacturers to produce lecithin with specific functional properties tailored to various applications. As these technologies continue to evolve, they are likely to enhance the competitiveness of lecithin products in the market, thereby driving growth within the Lecithin Market.