Health and Wellness Trends

The increasing consumer focus on health and wellness is a pivotal driver in the food beverage Market. As individuals become more health-conscious, there is a marked shift towards products that promote well-being. This trend is evidenced by the rise in demand for organic, low-calorie, and functional foods. According to recent data, the market for health-oriented food and beverages is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth reflects a broader societal shift towards preventive health measures, with consumers actively seeking products that align with their health goals. Consequently, companies within the Food Beverage Market are innovating to meet these demands, introducing new formulations and product lines that cater to health-conscious consumers.

Changing Consumer Preferences

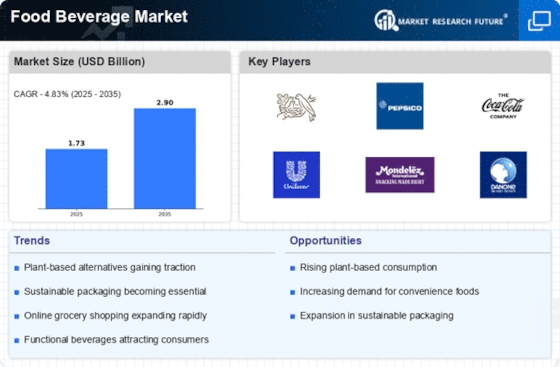

The Food Beverage Market is currently experiencing a shift in consumer preferences, with a notable increase in demand for plant-based and alternative protein products. This trend is driven by a combination of health concerns, environmental awareness, and ethical considerations regarding animal welfare. Recent market analysis suggests that the plant-based food sector is expected to grow by over 20% in the coming years, reflecting a significant change in dietary habits. As consumers seek diverse and innovative options, companies are responding by expanding their product offerings to include a wider range of plant-based alternatives. This shift not only caters to the evolving tastes of consumers but also positions businesses within the Food Beverage Market to capitalize on emerging opportunities.

Sustainability and Ethical Sourcing

Sustainability has emerged as a critical driver in the Food Beverage Market, as consumers increasingly prioritize environmentally friendly practices. The demand for sustainably sourced ingredients and eco-friendly packaging is on the rise, with many consumers willing to pay a premium for products that align with their values. Recent surveys indicate that over 60% of consumers consider sustainability when making purchasing decisions. This trend compels companies to adopt transparent supply chains and ethical sourcing practices, which not only enhance brand loyalty but also contribute to a positive corporate image. As the Food Beverage Market evolves, businesses that embrace sustainability are likely to gain a competitive edge, appealing to a growing demographic of environmentally conscious consumers.

E-commerce Growth and Digital Engagement

The rise of e-commerce is a transformative driver in the Food Beverage Market, fundamentally altering how consumers shop for food and beverages. With the increasing penetration of the internet and mobile devices, online grocery shopping has gained substantial traction. Recent statistics indicate that online food and beverage sales are projected to reach unprecedented levels, with a growth rate of approximately 15% annually. This shift necessitates that companies enhance their digital presence and engage with consumers through various online platforms. As a result, businesses are investing in user-friendly websites, mobile applications, and targeted digital marketing strategies to attract and retain customers. The Food Beverage Market must adapt to this evolving landscape to remain competitive and meet the changing preferences of consumers.

Technological Advancements in Production

Technological advancements are reshaping the Food Beverage Market, driving efficiency and innovation in production processes. Automation, artificial intelligence, and data analytics are increasingly utilized to optimize supply chains, enhance product quality, and reduce waste. For instance, the implementation of AI in food processing has been shown to improve yield and minimize spoilage, which is crucial in a market where margins can be tight. Furthermore, advancements in food preservation technologies are extending shelf life and improving food safety, thereby meeting consumer demands for freshness and quality. As these technologies continue to evolve, they are likely to play a significant role in shaping the future landscape of the Food Beverage Market.