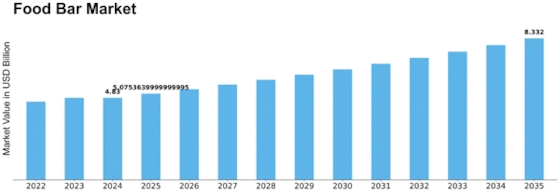

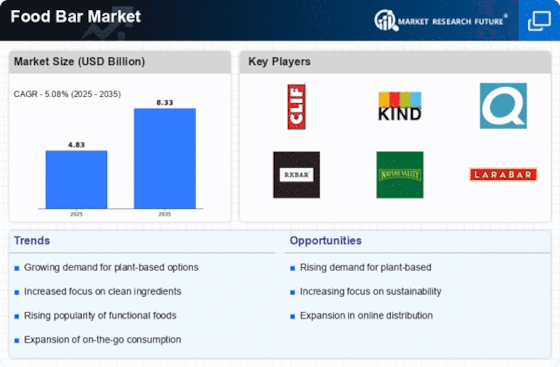

Food Bar Size

Food bar Market Growth Projections and Opportunities

The food bar market is influenced by a variety of factors that collectively shape its dynamics. One of the primary drivers is the changing consumer lifestyle, marked by a demand for convenient and portable snack options. Food bars, available in various formats such as protein bars, granola bars, and energy bars, cater to the on-the-go consumer seeking a quick and nutritious snack. The busy and fast-paced nature of modern life has led to an increased preference for food bars that offer convenience without compromising on taste or nutritional value. Global economic factors also play a significant role in the food bar market. Economic growth, rising disposable incomes, and urbanization contribute to increased consumer spending on convenience foods, including food bars. The expanding middle class, particularly in emerging markets, is more inclined to invest in convenient and healthier snack options, boosting the demand for food bars as a convenient and nutritious choice. Health and wellness trends are pivotal in shaping the food bar market. As consumers become more health-conscious, there is a growing demand for food bars that align with specific dietary preferences and nutritional goals. Protein bars, for example, cater to the fitness-conscious demographic seeking convenient sources of protein, while other bars may focus on being gluten-free, vegan, or free from artificial additives. The emphasis on clean-label and natural ingredients further drives innovation in the food bar market to meet evolving consumer expectations. Cultural influences and dietary habits also contribute to the dynamics of the food bar market. In regions where snacking is deeply ingrained in culinary traditions, the acceptance and popularity of food bars are higher. Understanding and adapting to regional taste preferences and dietary habits are crucial for market players to effectively tailor their products to diverse consumer bases. Government regulations and labeling standards are critical factors in the food bar market. Compliance with food safety regulations, nutritional labeling requirements, and health claims is essential for ensuring the quality and transparency of food bar products. Adhering to these standards not only meets regulatory obligations but also builds consumer trust in the safety and authenticity of the food bars. Technological advancements in food processing and packaging play a pivotal role in the food bar market. Innovations in ingredient processing, flavor encapsulation, and preservation technologies contribute to the development of food bars with improved taste, texture, and shelf life. Additionally, advancements in sustainable and eco-friendly packaging align with the increasing consumer preference for environmentally conscious choices, influencing the purchasing decisions of environmentally-aware consumers. Environmental sustainability is an emerging consideration in the food bar market. Consumers are increasingly concerned about the environmental impact of packaging and production processes. Market players are responding by exploring sustainable sourcing of ingredients, reducing packaging waste, and adopting eco-friendly packaging solutions to align with the values of environmentally-conscious consumers. Market volatility, in terms of ingredient prices, supply chain disruptions, and changing consumer preferences, can significantly impact the food bar market. Fluctuations in the prices of key ingredients, such as nuts, seeds, and grains, may influence production costs and pricing for consumers. Adapting to changes in consumer preferences and addressing potential supply chain challenges is crucial for market participants to remain agile and resilient.

Leave a Comment