Rising Food Safety Concerns

The increasing awareness regarding food safety is a primary driver for the Global Food Antimicrobial Additive Market Industry. Consumers are becoming more vigilant about the potential health risks associated with foodborne pathogens. This heightened concern has led to a growing demand for antimicrobial additives that can effectively inhibit microbial growth in food products. As a result, the market is projected to reach 2.34 USD Billion in 2024, reflecting the industry's response to consumer demands for safer food options. Regulatory bodies are also emphasizing the importance of food safety, further propelling the adoption of these additives in various food processing sectors.

Expansion of Processed Food Sector

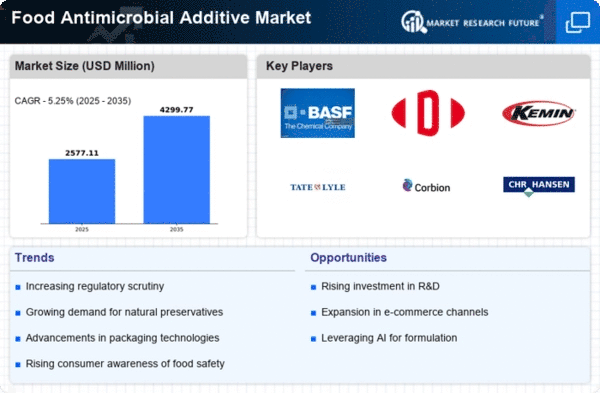

The rapid expansion of the processed food sector is a significant driver for the Global Food Antimicrobial Additive Market Industry. As urbanization and busy lifestyles lead to increased consumption of convenience foods, the need for effective preservation methods becomes paramount. Antimicrobial additives play a vital role in extending the shelf life of processed foods, ensuring safety and quality. This growing sector is expected to contribute substantially to market growth, with projections indicating a potential market size of 4.08 USD Billion by 2035. The interplay between consumer demand for convenience and the necessity for food safety is likely to sustain the momentum of this market.

Growing Demand for Natural Additives

The shift towards natural food additives is reshaping the Global Food Antimicrobial Additive Market Industry. Consumers are increasingly favoring products that contain natural ingredients over synthetic alternatives, driven by health consciousness and environmental concerns. This trend is prompting manufacturers to explore and develop natural antimicrobial agents derived from plant extracts and essential oils. As a result, the market is witnessing a gradual transition towards more sustainable and health-oriented solutions. This demand for natural additives is likely to influence product formulations and drive innovation within the industry, aligning with consumer preferences for cleaner labels.

Regulatory Support for Antimicrobial Use

Regulatory frameworks supporting the use of antimicrobial additives in food products are crucial for the Global Food Antimicrobial Additive Market Industry. Governments worldwide are establishing guidelines that facilitate the safe incorporation of these additives, ensuring they meet safety and efficacy standards. This regulatory backing encourages manufacturers to innovate and expand their product offerings, thereby enhancing market growth. As the industry adapts to these regulations, the market is anticipated to reach 4.08 USD Billion by 2035, reflecting the positive impact of supportive policies on the adoption of antimicrobial solutions in food processing.

Technological Advancements in Preservation

Technological innovations in food preservation techniques are significantly influencing the Global Food Antimicrobial Additive Market Industry. New methods, such as encapsulation and nano-technology, enhance the efficacy of antimicrobial agents, allowing for better shelf-life extension and food quality maintenance. These advancements not only improve the performance of existing additives but also lead to the development of novel antimicrobial solutions. As the market evolves, it is expected to grow at a CAGR of 5.18% from 2025 to 2035, indicating a robust future driven by continuous research and development in food preservation technologies.