Rising Demand in Automotive Sector

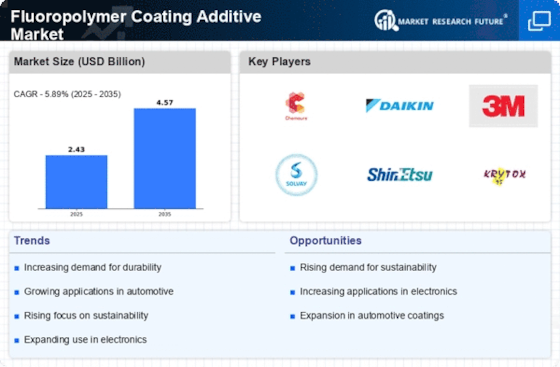

The automotive sector is experiencing a notable increase in demand for fluoropolymer coating additives, primarily due to their superior properties such as chemical resistance and low friction. These additives enhance the durability and performance of automotive components, which is crucial in meeting stringent regulatory standards. The Fluoropolymer Coating Additive Market is projected to witness a compound annual growth rate of approximately 5% over the next few years, driven by the need for lightweight and high-performance materials in vehicle manufacturing. As automotive manufacturers increasingly focus on improving fuel efficiency and reducing emissions, the adoption of fluoropolymer coatings is likely to expand, thereby bolstering the market.

Emerging Applications in Healthcare

The healthcare sector is increasingly recognizing the benefits of fluoropolymer coating additives, particularly in medical devices and equipment. These additives provide biocompatibility and resistance to sterilization processes, making them suitable for various applications, including surgical instruments and implants. The Fluoropolymer Coating Additive Market is likely to expand as healthcare providers seek materials that ensure safety and efficacy in medical applications. The market for medical coatings is projected to grow at a rate of 7% annually, reflecting the rising demand for advanced materials that meet stringent regulatory requirements in the healthcare industry.

Increasing Focus on Industrial Coatings

The industrial coatings segment is witnessing a surge in demand for fluoropolymer coating additives, driven by the need for protective solutions in various industries such as oil and gas, chemical processing, and manufacturing. These additives offer exceptional resistance to chemicals, heat, and abrasion, which are critical in harsh industrial environments. The Fluoropolymer Coating Additive Market is anticipated to grow as industries prioritize safety and efficiency. Recent estimates suggest that the industrial coatings market could reach USD 30 billion by 2026, with fluoropolymer additives playing a pivotal role in enhancing the performance and lifespan of coatings used in these applications.

Sustainability and Environmental Regulations

Sustainability initiatives and stringent environmental regulations are driving the demand for fluoropolymer coating additives. These additives are often formulated to be more environmentally friendly, aligning with global efforts to reduce the ecological footprint of industrial processes. The Fluoropolymer Coating Additive Market is adapting to these trends by developing products that comply with regulations while maintaining performance standards. As industries increasingly prioritize sustainable practices, the market for eco-friendly fluoropolymer coatings is expected to grow, potentially reaching USD 5 billion by 2028. This shift indicates a significant opportunity for manufacturers to innovate and meet the evolving needs of environmentally conscious consumers.

Growth in Electronics and Electrical Applications

The electronics and electrical applications are significantly contributing to the expansion of the Fluoropolymer Coating Additive Market. With the proliferation of electronic devices, there is a growing need for coatings that provide excellent insulation and protection against environmental factors. Fluoropolymer additives are favored for their ability to withstand high temperatures and corrosive substances, making them ideal for use in circuit boards and connectors. The market for these applications is expected to grow at a rate of around 6% annually, as manufacturers seek to enhance the reliability and longevity of electronic products. This trend indicates a robust future for fluoropolymer coatings in the electronics sector.