Rising Incidence of Cancer

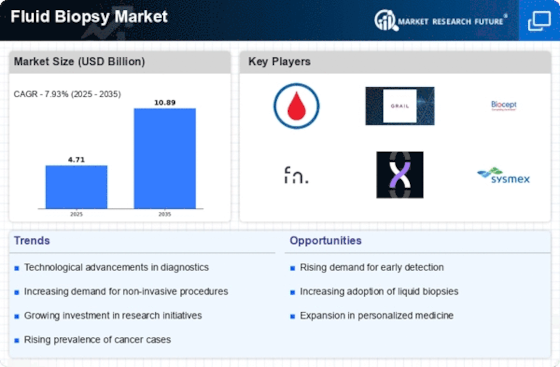

The Fluid Biopsy Market is significantly influenced by the rising incidence of cancer worldwide. As cancer rates continue to escalate, there is an urgent need for effective diagnostic tools that can facilitate early detection and ongoing monitoring. Liquid biopsies offer a promising solution, allowing for the identification of cancer biomarkers through minimally invasive procedures. Recent statistics indicate that cancer cases are expected to rise by nearly 50% by 2040, underscoring the critical demand for innovative diagnostic methods. This alarming trend is likely to drive investments and research in the Fluid Biopsy Market, as stakeholders seek to develop advanced solutions to combat the growing cancer burden.

Increased Focus on Personalized Medicine

The Fluid Biopsy Market is being propelled by an increased focus on personalized medicine, which emphasizes tailored treatment strategies based on individual patient profiles. Liquid biopsies play a crucial role in this paradigm by providing insights into the genetic makeup of tumors, enabling oncologists to select the most effective therapies for their patients. The ability to monitor treatment efficacy and detect resistance mutations in real-time further enhances the appeal of fluid biopsies in personalized treatment plans. As the market for personalized medicine expands, the Fluid Biopsy Market is expected to grow substantially, with projections indicating a potential market size increase of over 30% in the coming years.

Growing Demand for Non-Invasive Diagnostics

The Fluid Biopsy Market is witnessing a surge in demand for non-invasive diagnostic methods, which are perceived as safer and more patient-friendly compared to traditional tissue biopsies. Patients and healthcare providers alike are increasingly favoring procedures that minimize discomfort and risk. This shift is particularly evident in oncology, where liquid biopsies allow for the analysis of tumor-derived materials from blood samples. The convenience and reduced recovery time associated with non-invasive diagnostics are likely to contribute to a projected market growth rate of approximately 15% annually. As healthcare systems continue to prioritize patient-centric approaches, the Fluid Biopsy Market is poised to benefit significantly from this trend.

Regulatory Support and Reimbursement Policies

The Fluid Biopsy Market is benefiting from favorable regulatory support and evolving reimbursement policies that encourage the adoption of liquid biopsy technologies. Regulatory bodies are increasingly recognizing the clinical utility of liquid biopsies, leading to expedited approvals for innovative diagnostic tests. Additionally, many healthcare payers are beginning to cover liquid biopsy procedures, which enhances accessibility for patients and healthcare providers. This supportive environment is likely to stimulate market growth, as it reduces financial barriers and encourages the integration of fluid biopsies into standard clinical practice. As reimbursement frameworks continue to evolve, the Fluid Biopsy Market is expected to see a significant uptick in utilization and acceptance.

Technological Advancements in Fluid Biopsy Market

The Fluid Biopsy Market is experiencing rapid technological advancements that enhance the accuracy and efficiency of diagnostic procedures. Innovations in liquid biopsy technologies, such as next-generation sequencing and digital PCR, are enabling the detection of circulating tumor DNA and other biomarkers with unprecedented sensitivity. These advancements are not only improving early cancer detection rates but also facilitating real-time monitoring of treatment responses. According to recent estimates, the liquid biopsy segment is projected to grow at a compound annual growth rate of over 20% through the next few years. This growth is indicative of the increasing reliance on advanced technologies to provide precise and timely diagnostic information, thereby driving the Fluid Biopsy Market forward.