E-commerce Integration

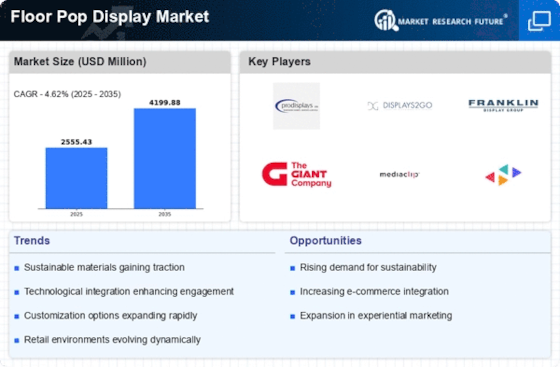

The Floor Pop Display Market is adapting to the rise of e-commerce by integrating online and offline shopping experiences. Retailers are increasingly using floor pop displays to promote their online platforms within physical stores. This strategy not only enhances the in-store experience but also encourages customers to engage with digital channels. Data indicates that retailers who effectively bridge the gap between online and offline sales can achieve a 15% increase in overall revenue. As the lines between e-commerce and traditional retail continue to blur, the Floor Pop Display Market is poised for significant growth.

Rising Retail Competition

The Floor Pop Display Market is experiencing a surge in demand due to increasing competition among retailers. As businesses strive to differentiate themselves, they are investing in innovative display solutions to attract customers. This trend is particularly evident in sectors such as fashion and electronics, where visual appeal plays a crucial role in consumer decision-making. According to recent data, retailers that utilize effective floor pop displays can see a 20% increase in foot traffic, which directly correlates with higher sales. The need for retailers to stand out in a crowded marketplace is likely to drive further growth in the Floor Pop Display Market.

Sustainability Initiatives

Sustainability is becoming a key focus within the Floor Pop Display Market. Retailers are increasingly seeking eco-friendly materials and practices in their display solutions. This shift is driven by consumer demand for sustainable products and corporate responsibility. Data suggests that 60% of consumers prefer brands that demonstrate environmental consciousness. As a result, manufacturers are innovating with recyclable materials and sustainable production methods, which not only appeal to eco-conscious consumers but also enhance brand image. The growing emphasis on sustainability is likely to shape the future of the Floor Pop Display Market.

Technological Advancements

Technological advancements are significantly influencing the Floor Pop Display Market. The integration of digital technologies, such as augmented reality and interactive displays, is transforming traditional merchandising strategies. Retailers are leveraging these technologies to create dynamic and engaging shopping experiences that capture consumer attention. For instance, displays that incorporate QR codes or touch screens can provide additional product information and promotions, enhancing customer engagement. As technology continues to evolve, the Floor Pop Display Market is expected to witness increased investment in innovative display solutions that cater to tech-savvy consumers.

Consumer Experience Enhancement

Enhancing consumer experience is a pivotal driver in the Floor Pop Display Market. Retailers are recognizing the importance of creating immersive shopping environments that engage customers on multiple sensory levels. Innovative floor pop displays that incorporate interactive elements or unique designs can significantly enhance the shopping experience. Research shows that 70% of consumers are more likely to purchase from a store that offers an engaging display. As retailers prioritize customer satisfaction and loyalty, the demand for sophisticated floor pop displays is expected to rise, further propelling the Floor Pop Display Market.