Research Methodology on Under Floor Heating Market

This report is prepared to offer an in-depth analysis of the current market size of the Under Floor Heating Market across the globe and its forecast till 2030. For this, extensive research and analysis have been conducted extensively to capture the market dynamics accurately. Also, a thorough investigation was conducted to assess the current trends, market outlook, drivers, restraints, and opportunities that exist in the market. The report aims to provide the stakeholders with an accurate assessment of the market and key insights into the Under Floor Heating Market.

Research Objectives

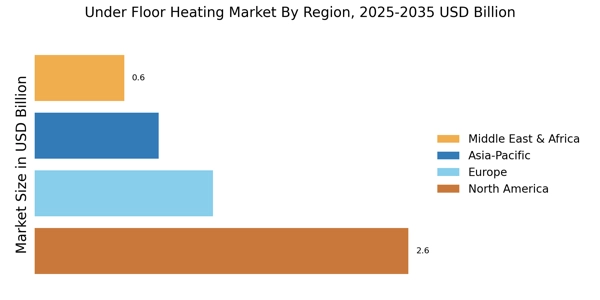

The primary objective of this report is to offer an exhaustive assessment of the Under Floor Heating Market across the globe. The analysis presented in the report has been conducted across various regions and countries including- North America, Europe, Asia-Pacific, and the Rest of the World. This report covers different aspects of the Under Floor Heating Market such as the size of the market, revenue estimation, market drivers, challenges, value chain analysis, and regional and country-level market analysis.

Research Sources and Methods

The research sources used for the compilation of this report included industry publications, secondary sources, industry associations, and printed and online sources. The report covers an in-depth analysis of the Under Floor Heating Market by using various Nationally recognized organizations and companies’ data sources. The secondary data used for market sizing and market forecasting has come from primary data sources such as news articles, magazines, surveys, and interviews. The primary data sources have been supplemented by industry bodies.

Market Size Estimation

The market size estimation conducted in this study was based on a bottom-up approach. To determine the market size and the estimated total market, a combination of top-down and bottom-up approaches has been employed. The Under Floor Heating Market size estimated in the bottom-up approach has been validated using the top-down approach. Multiple data points have been gathered and analyzed to ascertain the accurate market size of the Under Floor Heating market. Once the market size was determined, the next step was to compute the revenue estimation and market share of the key players operating in the Under Floor Heating market.

Demand Side Data Triangulation

The market size was determined based on the demand-side data triangulation approach. This approach included an in-depth review and analysis of market dynamics, penetration of Under Floor Heating systems, current and future trends in the demand for Under Floor Heating systems, the market size across different regions and a review of the various market participants.

Supply Side Data Triangulation

The supply-side data triangulation used in this study was based on the historical data regarding the Under Floor Heating market, and the input from the interviews conducted with different market participants, such as production companies, suppliers, distributors, and research institutes. This supply-side data triangulation approach has been used to estimate the market size and its further analysis for different regions.

Market Forecasting

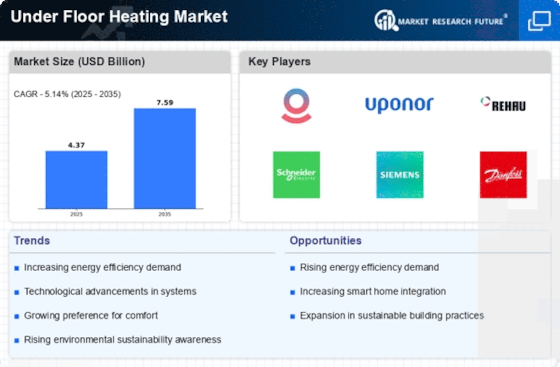

The market forecast presented in this report was derived based on an in-depth analysis of the market dynamics, past and future market trends, and the present and future market size. The market is expected to witness growth in the coming years due to various factors such as increasing demand for energy-efficient systems, rising technological advancements in the field of Under Floor Heating systems, and the increasing proliferation of such systems in residential and commercial applications. The forecast presented in this report is based on a detailed time-series analysis, which includes various macroeconomic indicators such as GDP, population growth, global industrial output, and various others.

Data Analysis

The market analysis conducted in this study was based on an in-depth analysis of the extensive data gathered from various sources. This includes demand-side data, supply-side data, macroeconomic indicators, and various other factors. The collected data was analyzed using various analytical tools such as factor analysis, linear regression analysis, and others to draw meaningful conclusions. The data analysis was further segmented into regional and country-level components to gain a better understanding of the market dynamics.

Conclusion

The research conducted in this report is comprehensive and provides a thorough assessment of the Under Floor Heating Market across the globe. This report provides an in-depth analysis of the market size, current and future market trends, market drivers, restraints, and opportunities. The report also covers an in-depth analysis of the competitive landscape, market strategies, value chain analysis, regional and country-level market analysis, and other factors that impact the Under Floor Heating Market.