North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Flight Data Monitoring and MRO Services Market, holding a significant market share of 3.25 billion. The region benefits from advanced technological infrastructure, a high demand for safety and efficiency in aviation, and stringent regulatory frameworks that promote innovation. The increasing adoption of data analytics and predictive maintenance solutions further drives market growth, ensuring compliance with safety regulations and enhancing operational efficiency.

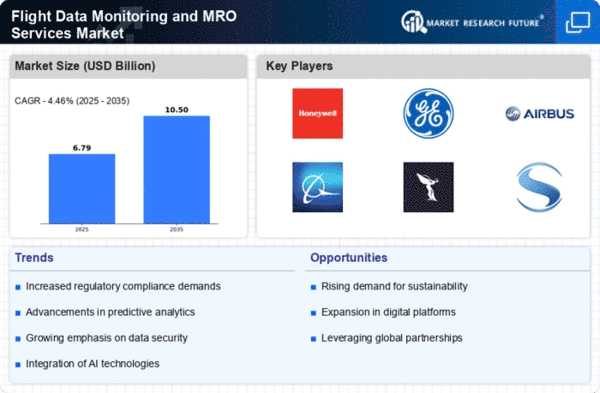

The competitive landscape in North America is robust, featuring key players such as Honeywell, General Electric, and Boeing. These companies are at the forefront of technological advancements, offering cutting-edge solutions that cater to the evolving needs of the aviation sector. The presence of major airlines and a strong military aviation sector also contribute to the region's dominance, making it a hub for MRO services and flight data monitoring solutions.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for Flight Data Monitoring and MRO Services, with a market size of 1.8 billion. The region's focus on enhancing aviation safety standards and regulatory compliance is a key driver of market growth. Initiatives by the European Union Aviation Safety Agency (EASA) to implement stringent safety regulations are catalyzing investments in advanced monitoring technologies. The increasing emphasis on sustainability and reducing carbon emissions is also shaping the market landscape, pushing for innovative solutions.

Leading countries in Europe, such as France, Germany, and the UK, are home to major players like Airbus and Rolls-Royce. The competitive environment is characterized by collaborations and partnerships aimed at enhancing service offerings. The presence of established aerospace manufacturers and a growing number of startups focused on data analytics and monitoring solutions further enriches the market, positioning Europe as a significant player in the global aviation sector.

Asia-Pacific : Rapidly Growing Aviation Hub

Asia-Pacific is emerging as a significant player in the Flight Data Monitoring and MRO Services Market, with a market size of 1.5 billion. The region's rapid economic growth, increasing air travel demand, and investments in aviation infrastructure are key growth drivers. Governments are also implementing supportive regulations to enhance safety and operational efficiency, which is further propelling market expansion. The rise of low-cost carriers and the modernization of existing fleets are additional factors contributing to the demand for MRO services.

Countries like China, India, and Japan are leading the charge in this region, with a growing number of airlines and aircraft operators. The competitive landscape is becoming increasingly dynamic, with both established players and new entrants vying for market share. Key companies such as Thales and L3Harris Technologies are actively investing in innovative solutions to meet the evolving needs of the aviation industry, ensuring that Asia-Pacific remains a vital market for flight data monitoring and MRO services.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually developing its Flight Data Monitoring and MRO Services Market, currently valued at 0.95 billion. The growth is driven by increasing air traffic, investments in airport infrastructure, and a rising focus on aviation safety. However, the market faces challenges such as regulatory inconsistencies and varying levels of technological adoption across countries. Governments are beginning to recognize the importance of enhancing aviation safety and operational efficiency, which is expected to drive future growth.

Leading countries in this region include the UAE and South Africa, where significant investments in aviation infrastructure are being made. The competitive landscape is characterized by a mix of local and international players, with companies like Safran and Rolls-Royce establishing a presence. As the region continues to develop its aviation capabilities, the demand for advanced MRO services and flight data monitoring solutions is anticipated to grow, presenting opportunities for both established and new market entrants.