Focus on Environmental Sustainability

The US Flight Data Monitoring Market is increasingly aligning with the global focus on environmental sustainability. Airlines are under pressure to reduce their carbon footprint and improve fuel efficiency, which has led to a heightened interest in flight data monitoring systems. These systems provide critical data that can help airlines optimize flight paths and reduce fuel consumption. As a result, the market for flight data monitoring solutions that emphasize sustainability is likely to grow. Industry reports suggest that the demand for environmentally friendly aviation practices could drive market growth to USD 1 billion by 2027, reflecting a significant shift towards sustainable operations.

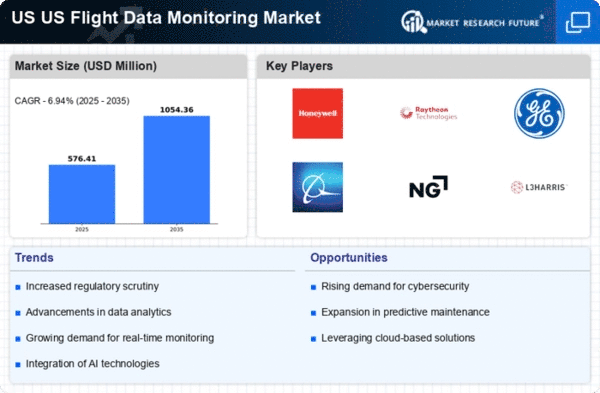

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into flight data monitoring systems is emerging as a key driver in the US Flight Data Monitoring Market. AI technologies enable more sophisticated data analysis, allowing for the identification of patterns and anomalies that may not be apparent through traditional methods. This capability enhances predictive maintenance and safety measures, ultimately leading to improved operational performance. As airlines increasingly recognize the benefits of AI, the market for AI-driven flight data monitoring solutions is expected to expand significantly. Projections indicate a potential growth rate of 15% annually in this segment over the next few years.

Growing Demand for Operational Efficiency

The US Flight Data Monitoring Market is witnessing a growing demand for operational efficiency among airlines and operators. As competition intensifies, airlines are increasingly focusing on optimizing their operations to reduce costs and enhance profitability. Flight data monitoring systems provide valuable insights into flight performance, fuel consumption, and maintenance needs, enabling airlines to make data-driven decisions. This trend is expected to drive the market, with estimates suggesting a potential market size of USD 1.2 billion by 2026. The emphasis on operational efficiency is likely to propel the adoption of advanced flight data monitoring solutions.

Regulatory Compliance and Safety Standards

In the US Flight Data Monitoring Market, stringent regulatory compliance and safety standards play a pivotal role in shaping market dynamics. The Federal Aviation Administration (FAA) mandates that airlines implement flight data monitoring systems to enhance safety and operational efficiency. This regulatory framework not only ensures adherence to safety protocols but also fosters innovation in monitoring technologies. As airlines strive to meet these regulations, investments in flight data monitoring systems are expected to increase. The market is projected to reach USD 1.5 billion by 2028, reflecting the growing emphasis on compliance and safety in the aviation sector.

Technological Advancements in Data Analytics

The US Flight Data Monitoring Market is experiencing a surge in technological advancements, particularly in data analytics. Enhanced algorithms and machine learning techniques are being integrated into flight data monitoring systems, allowing for real-time analysis and predictive maintenance. This shift not only improves safety but also optimizes operational efficiency. According to recent data, the market for advanced analytics in aviation is projected to grow at a compound annual growth rate of 12% over the next five years. As airlines and operators increasingly adopt these technologies, the demand for sophisticated flight data monitoring solutions is likely to rise, driving market growth.