Growth in Automotive Applications

The automotive sector is becoming a significant driver for the Flexible Polyurethane Foam Market. With the increasing focus on lightweight materials to enhance fuel efficiency, flexible polyurethane foam is being utilized in various applications, including seating, insulation, and soundproofing. The automotive industry is projected to witness a growth rate of around 4% annually, as manufacturers seek to improve vehicle performance while adhering to stringent environmental regulations. This trend indicates a robust demand for flexible polyurethane foam, which offers excellent properties such as energy absorption and thermal insulation. As a result, the Flexible Polyurethane Foam Market is poised to expand in tandem with the automotive sector's evolving needs.

Innovations in Packaging Solutions

Innovative packaging solutions are emerging as a key driver for the Flexible Polyurethane Foam Market. The demand for protective packaging materials is on the rise, particularly in sectors such as electronics and consumer goods. Flexible polyurethane foam provides superior cushioning and protection, which is essential for fragile items during transportation. The packaging segment is expected to grow at a rate of approximately 6% per year, driven by the increasing e-commerce activities and the need for sustainable packaging solutions. This growth presents a substantial opportunity for the Flexible Polyurethane Foam Market, as manufacturers develop new formulations that enhance performance while meeting environmental standards.

Expansion of Healthcare Applications

The healthcare sector is increasingly adopting flexible polyurethane foam, which serves as a vital driver for the Flexible Polyurethane Foam Market. This material is utilized in various applications, including medical mattresses, cushions, and prosthetics, due to its comfort and adaptability. The healthcare industry is projected to grow at a rate of approximately 7% annually, fueled by the rising demand for patient comfort and support. As healthcare providers prioritize quality care, the need for high-performance materials like flexible polyurethane foam becomes more pronounced. This trend suggests that the Flexible Polyurethane Foam Market will continue to expand as it meets the evolving requirements of the healthcare sector.

Increasing Focus on Energy Efficiency

The emphasis on energy efficiency is significantly influencing the Flexible Polyurethane Foam Market. As industries strive to reduce energy consumption and carbon footprints, flexible polyurethane foam is being recognized for its insulating properties. This material is widely used in construction applications, such as insulation for walls, roofs, and floors, contributing to energy savings in buildings. The construction sector is anticipated to grow at a rate of around 5% annually, driven by the global push for sustainable building practices. Consequently, the Flexible Polyurethane Foam Market is likely to see increased demand as builders and architects seek materials that enhance energy efficiency and comply with green building standards.

Rising Demand in Furniture and Bedding Sectors

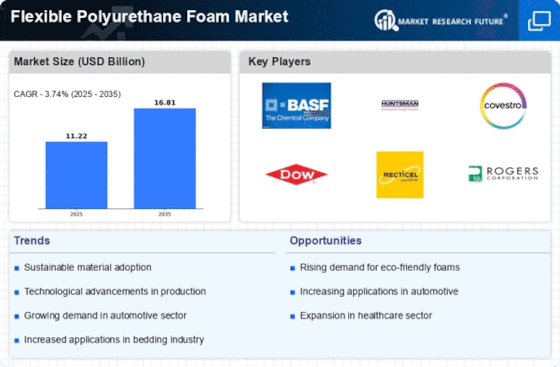

The Flexible Polyurethane Foam Market is experiencing a notable surge in demand, particularly from the furniture and bedding sectors. As consumers increasingly prioritize comfort and quality in their living spaces, manufacturers are responding by incorporating high-quality flexible polyurethane foam into their products. The bedding segment alone is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is driven by the rising awareness of the importance of sleep quality, leading to a preference for mattresses that utilize advanced foam technologies. Consequently, the Flexible Polyurethane Foam Market is likely to benefit from this trend, as it aligns with consumer preferences for durable and comfortable materials.