Rising Demand for Convenience

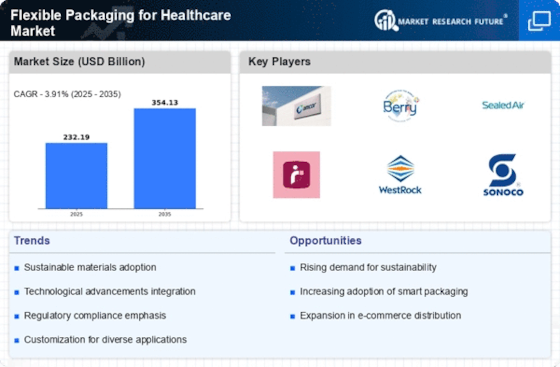

The Flexible Packaging for Healthcare Market experiences a notable increase in demand for convenience-driven solutions. As healthcare providers and patients seek more user-friendly packaging options, flexible packaging emerges as a preferred choice. This trend is particularly evident in the pharmaceutical sector, where packaging that facilitates easy access to medications is crucial. In 2025, the market for flexible packaging in healthcare is projected to reach approximately USD 30 billion, reflecting a compound annual growth rate of around 5%. This growth is driven by the need for packaging that not only preserves product integrity but also enhances patient compliance and satisfaction. The emphasis on convenience is likely to continue shaping the industry, as stakeholders prioritize solutions that streamline the user experience.

Technological Innovations in Packaging

Technological advancements play a crucial role in the evolution of the Flexible Packaging for Healthcare Market. Innovations such as smart packaging, which incorporates sensors and indicators, are gaining traction. These technologies enhance the functionality of packaging by providing real-time information about product conditions, such as temperature and humidity. As healthcare systems increasingly adopt these technologies, the market for flexible packaging is expected to expand. By 2025, the integration of technology into packaging solutions could account for a substantial share of the market, as stakeholders seek to improve product traceability and patient safety. This trend indicates a shift towards more sophisticated packaging solutions that cater to the evolving needs of the healthcare sector.

Increased Focus on Safety and Compliance

Safety and compliance remain paramount in the Flexible Packaging for Healthcare Market. Regulatory bodies impose stringent guidelines on packaging materials to ensure they meet safety standards. Flexible packaging, often made from materials that are easier to sterilize and less prone to contamination, aligns well with these requirements. The market is witnessing a shift towards packaging solutions that not only comply with regulations but also enhance product safety. In 2025, the demand for compliant packaging solutions is expected to drive a significant portion of the market, as healthcare providers prioritize patient safety. This focus on safety is likely to foster innovation in packaging materials and designs, further propelling the growth of the flexible packaging sector.

Sustainability and Eco-Friendly Practices

Sustainability initiatives are becoming increasingly relevant in the Flexible Packaging for Healthcare Market. As environmental concerns rise, healthcare companies are seeking packaging solutions that minimize waste and reduce carbon footprints. Flexible packaging, often lighter and requiring less material than traditional packaging, presents an opportunity for companies to adopt more sustainable practices. In 2025, the market for eco-friendly flexible packaging is projected to grow significantly, driven by consumer demand for environmentally responsible products. This shift towards sustainability not only aligns with global environmental goals but also enhances brand reputation among consumers. The emphasis on eco-friendly practices is likely to influence packaging design and material selection in the healthcare sector.

Growing E-commerce and Home Healthcare Trends

The rise of e-commerce and home healthcare services is reshaping the Flexible Packaging for Healthcare Market. As more patients receive care at home, the demand for packaging that ensures product safety during transit becomes critical. Flexible packaging offers advantages such as lightweight and space-efficient designs, making it ideal for shipping healthcare products. The e-commerce sector is projected to grow at a rapid pace, with estimates suggesting that online sales of healthcare products could reach USD 15 billion by 2025. This trend necessitates packaging solutions that not only protect products but also enhance the overall customer experience. The intersection of e-commerce and healthcare is likely to drive innovation in flexible packaging, as companies seek to meet the unique needs of home healthcare consumers.