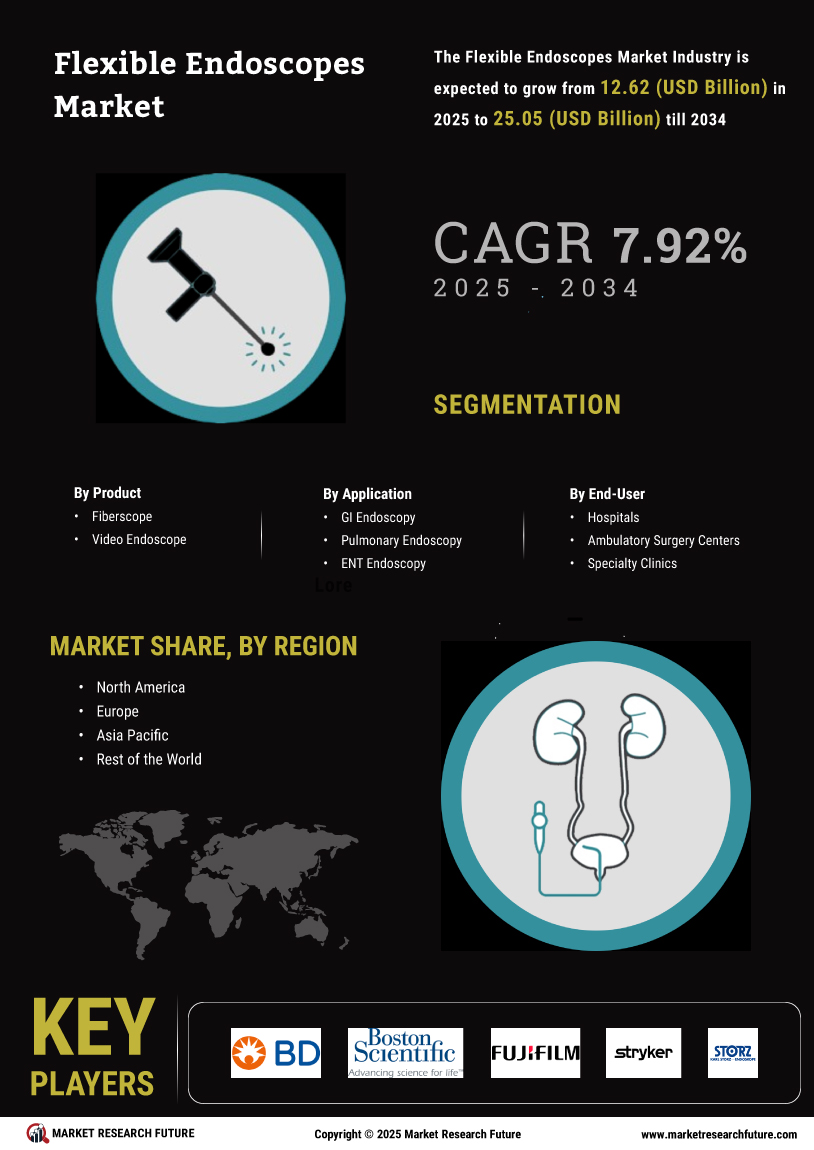

Shift Towards Single-Use Devices

The Flexible Endoscopes Market is witnessing a notable shift towards single-use devices, driven by the need for enhanced safety and infection control. Single-use flexible endoscopes eliminate the risks associated with reprocessing and cross-contamination, which have become critical concerns in healthcare settings. Recent statistics suggest that the single-use segment is projected to grow significantly, as hospitals and clinics prioritize patient safety. This trend is particularly relevant in light of increasing regulatory scrutiny regarding infection control practices. As healthcare facilities aim to reduce the incidence of hospital-acquired infections, the adoption of single-use flexible endoscopes is likely to accelerate. This shift not only addresses safety concerns but also streamlines operational processes, making it a compelling choice for healthcare providers. Consequently, the Flexible Endoscopes Market is expected to expand as single-use devices gain traction.

Focus on Patient Comfort and Experience

The Flexible Endoscopes Market is increasingly focusing on patient comfort and experience, which is becoming a pivotal driver of market growth. As healthcare providers recognize the importance of patient satisfaction, innovations aimed at minimizing discomfort during procedures are gaining traction. Developments such as softer, more flexible materials and ergonomic designs are being integrated into endoscope manufacturing. Research indicates that procedures designed with patient comfort in mind can lead to higher acceptance rates and improved outcomes. Additionally, the incorporation of sedation techniques and advanced imaging technologies enhances the overall experience for patients undergoing endoscopic procedures. This emphasis on patient-centric approaches is likely to influence purchasing decisions among healthcare facilities, thereby propelling the demand for flexible endoscopes. As a result, the Flexible Endoscopes Market is poised for growth, driven by the commitment to improving patient comfort.

Rising Incidence of Gastrointestinal Disorders

The Flexible Endoscopes Market is significantly influenced by the rising incidence of gastrointestinal disorders, which necessitate advanced diagnostic and therapeutic interventions. Conditions such as colorectal cancer, inflammatory bowel disease, and gastroesophageal reflux disease are becoming increasingly prevalent, leading to a higher demand for flexible endoscopic procedures. Recent epidemiological data indicates that the global burden of gastrointestinal diseases is on the rise, prompting healthcare systems to invest in advanced endoscopic technologies. This trend is likely to drive the growth of the flexible endoscopes market, as healthcare providers seek effective solutions for early detection and treatment. Moreover, the increasing awareness of preventive healthcare measures is encouraging individuals to undergo regular screenings, further boosting the demand for flexible endoscopes. Consequently, the Flexible Endoscopes Market is expected to expand in response to the growing need for effective gastrointestinal care.

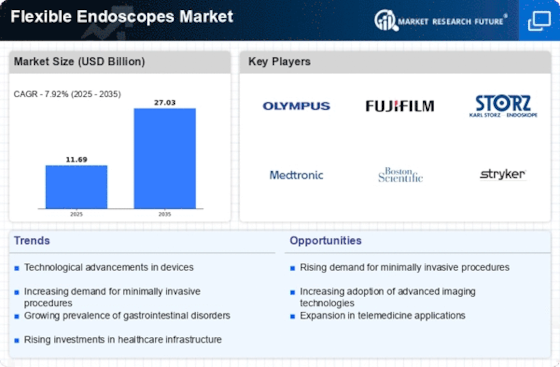

Technological Advancements in Flexible Endoscopes

The Flexible Endoscopes Market is experiencing a surge in technological advancements that enhance diagnostic and therapeutic capabilities. Innovations such as high-definition imaging, narrow-band imaging, and advanced light sources are becoming increasingly prevalent. These technologies improve visualization, allowing for more accurate diagnoses and better treatment outcomes. According to recent data, the integration of artificial intelligence in endoscopic procedures is expected to grow, potentially increasing efficiency and precision. As healthcare providers seek to adopt the latest technologies, the demand for advanced flexible endoscopes is likely to rise, driving market growth. Furthermore, the development of robotic-assisted endoscopy is anticipated to revolutionize procedures, making them less invasive and more effective. This trend indicates a promising future for the Flexible Endoscopes Market, as technological enhancements continue to evolve.

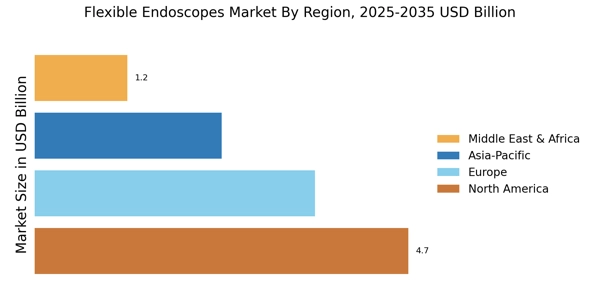

Aging Population and Increased Healthcare Expenditure

The Flexible Endoscopes Market is being propelled by the aging population and the corresponding increase in healthcare expenditure. As the global demographic landscape shifts towards an older population, the prevalence of age-related health issues, including various gastrointestinal disorders, is expected to rise. This demographic trend is likely to result in higher demand for diagnostic and therapeutic procedures, including those utilizing flexible endoscopes. Additionally, increased healthcare expenditure in many regions is facilitating the adoption of advanced medical technologies. Governments and private sectors are investing in healthcare infrastructure, which includes the procurement of state-of-the-art flexible endoscopes. This investment is indicative of a broader commitment to improving healthcare outcomes and access to quality care. As a result, the Flexible Endoscopes Market is anticipated to grow, driven by the dual forces of an aging population and rising healthcare investments.