Regulatory Compliance

Stringent fire safety regulations and standards imposed by governments worldwide are pivotal in shaping the Global Fixed Fire Fighting Systems (FFFS) Market Industry. Compliance with these regulations is not merely a legal obligation but also a critical factor in ensuring safety in commercial and residential buildings. As authorities enforce stricter codes, businesses are compelled to upgrade or install FFFS to meet these requirements. This regulatory landscape is expected to bolster market growth, as organizations prioritize compliance to avoid penalties and enhance safety. The ongoing evolution of fire safety regulations is likely to further stimulate demand for innovative FFFS solutions.

Increasing Urbanization

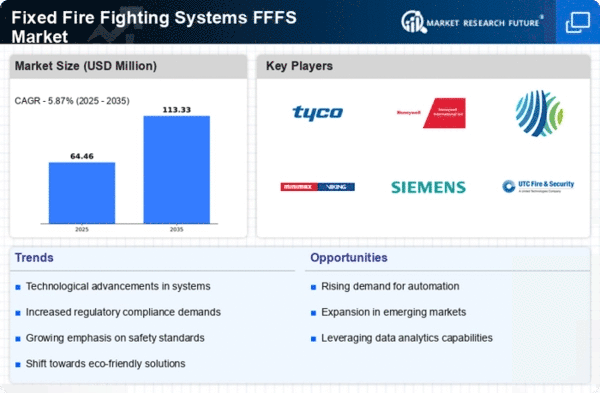

The rapid pace of urbanization globally drives the demand for Fixed Fire Fighting Systems (FFFS). As more people migrate to urban areas, the density of buildings and infrastructure increases, necessitating advanced fire safety measures. In 2024, the Global Fixed Fire Fighting Systems (FFFS) Market Industry is valued at approximately 60.9 USD Billion, reflecting the urgent need for effective fire protection solutions in densely populated regions. Urban centers are particularly vulnerable to fire hazards, prompting governments and private sectors to invest in robust FFFS to safeguard lives and property. This trend is expected to continue, with the market projected to grow significantly in the coming years.

Technological Advancements

Technological innovations in fire detection and suppression systems are transforming the Global Fixed Fire Fighting Systems (FFFS) Market Industry. Advancements such as smart fire alarms, automated suppression systems, and integration with IoT technologies enhance the effectiveness and efficiency of fire safety measures. These technologies not only improve response times but also provide real-time monitoring capabilities, which are increasingly sought after in various sectors, including industrial, commercial, and residential. As the market evolves, the adoption of these advanced technologies is expected to drive substantial growth, with projections indicating a rise to 113.9 USD Billion by 2035.

Expansion of Industrial Sector

The expansion of the industrial sector globally is a crucial driver for the Global Fixed Fire Fighting Systems (FFFS) Market Industry. Industries such as manufacturing, oil and gas, and chemicals are inherently at risk of fire hazards due to the nature of their operations. As these sectors grow, the demand for reliable fire protection systems becomes increasingly critical. Companies are investing in advanced FFFS to mitigate risks and ensure compliance with safety regulations. This trend is anticipated to contribute to a compound annual growth rate (CAGR) of 5.87% from 2025 to 2035, reflecting the ongoing commitment to enhancing fire safety in industrial environments.

Rising Awareness of Fire Safety

Growing awareness regarding fire safety among businesses and consumers significantly influences the Global Fixed Fire Fighting Systems (FFFS) Market Industry. Educational campaigns and high-profile fire incidents have heightened public consciousness about the importance of fire prevention and protection. This increased awareness leads to greater investments in FFFS, as organizations recognize the potential risks associated with inadequate fire safety measures. Consequently, the market is likely to experience robust growth, driven by a collective commitment to enhancing safety standards across various sectors. The emphasis on proactive fire safety measures is expected to sustain demand for FFFS in the foreseeable future.