Technological Innovations

Technological innovations are a driving force in the armored fighting vehicle Market. The integration of advanced technologies such as artificial intelligence, autonomous systems, and enhanced armor materials is transforming the capabilities of armored vehicles. These innovations not only improve operational effectiveness but also enhance survivability on the battlefield. The market is witnessing a shift towards vehicles equipped with cutting-edge systems that provide real-time data analysis and situational awareness. As defense contractors invest in research and development, the introduction of next-generation armored vehicles is anticipated to attract significant interest from military organizations, thereby propelling market growth.

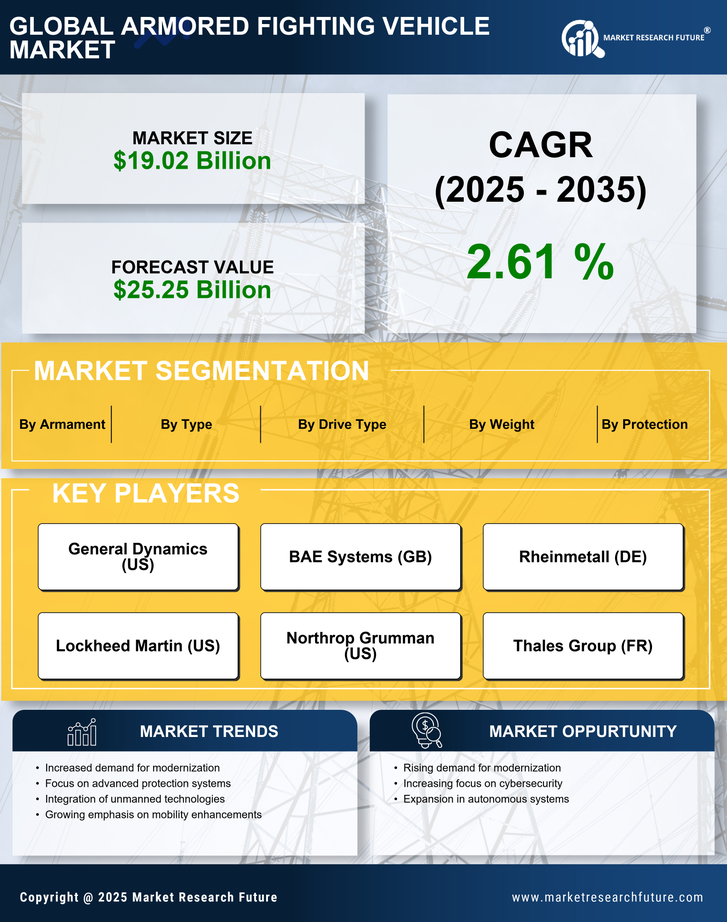

Increasing Defense Budgets

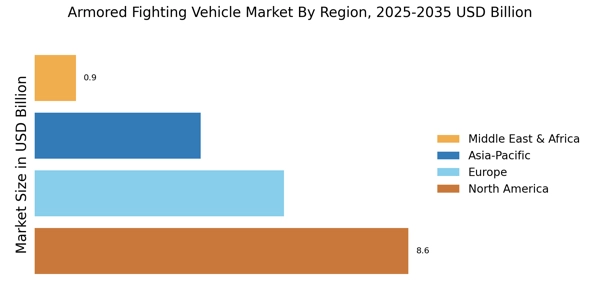

The Armored Fighting Vehicle Market is experiencing a notable surge in defense budgets across various nations. Governments are prioritizing military modernization, which includes the procurement of advanced armored fighting vehicles. For instance, defense spending in regions such as Europe and Asia has seen a consistent increase, with some countries allocating over 2% of their GDP to defense. This trend is likely to bolster the demand for armored vehicles, as nations seek to enhance their military capabilities in response to evolving threats. The emphasis on upgrading existing fleets and acquiring new technologies is expected to drive market growth, as countries invest in vehicles that offer superior protection and operational efficiency.

Rising Geopolitical Tensions

The Armored Fighting Vehicle Market is significantly influenced by rising geopolitical tensions. As nations face increasing threats from regional conflicts and terrorism, the demand for armored fighting vehicles is likely to escalate. Countries are compelled to enhance their military readiness, leading to increased procurement of advanced armored vehicles. For example, tensions in Eastern Europe and the Middle East have prompted several nations to reevaluate their defense strategies, resulting in a surge in military spending. This environment of uncertainty and potential conflict is expected to sustain the growth of the armored fighting vehicle market, as nations prioritize the acquisition of robust and versatile military assets.

Focus on Modern Warfare Strategies

The Armored Fighting Vehicle Market is adapting to the evolving landscape of modern warfare strategies. As military operations increasingly emphasize mobility, versatility, and rapid deployment, the demand for advanced armored fighting vehicles is likely to rise. Modern conflicts often require vehicles that can operate in diverse environments and support joint operations. Consequently, defense forces are seeking vehicles that not only provide protection but also enhance operational capabilities. This shift in focus is expected to drive innovation and investment in the development of multi-role armored vehicles, which can effectively respond to a variety of combat scenarios.

Increased Demand for Peacekeeping Missions

The Armored Fighting Vehicle Market is also influenced by the rising demand for peacekeeping missions. As international organizations and coalitions engage in peacekeeping and humanitarian operations, the need for armored vehicles that can operate in complex environments becomes paramount. These missions often require vehicles that offer protection for personnel while ensuring mobility in challenging terrains. Consequently, nations are investing in armored fighting vehicles that are specifically designed for peacekeeping roles. This trend is likely to sustain market growth, as countries recognize the importance of equipping their forces with vehicles capable of fulfilling diverse operational requirements.