Emergence of 5G Technology

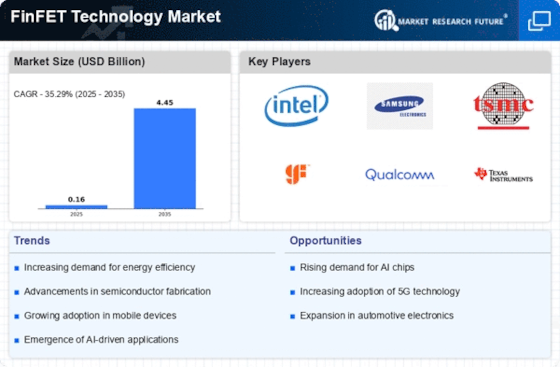

The FinFET Technology Market is significantly impacted by the emergence of 5G technology, which necessitates advanced semiconductor solutions. The rollout of 5G networks requires high-speed data processing and low-latency communication, both of which are facilitated by FinFET technology. As telecommunications companies invest heavily in 5G infrastructure, the demand for FinFET-based chips is likely to increase. Market forecasts indicate that the 5G infrastructure market could exceed USD 50 billion by 2026, creating substantial opportunities for FinFET technology adoption. This trend highlights the critical role that FinFETs will play in enabling the next generation of wireless communication, further solidifying their importance in the semiconductor landscape.

Increasing Demand for Miniaturization

The FinFET Technology Market is experiencing a pronounced demand for miniaturization in semiconductor devices. As consumer electronics evolve, there is a growing need for smaller, more efficient chips that can deliver high performance without compromising on power consumption. This trend is particularly evident in mobile devices, where space is at a premium. According to recent data, the market for mobile devices is projected to reach over 1.5 billion units by 2026, driving the need for advanced FinFET technology. The ability of FinFETs to maintain performance while reducing size positions them as a critical component in meeting these market demands. Consequently, manufacturers are increasingly adopting FinFET technology to enhance their product offerings and remain competitive in a rapidly evolving landscape.

Regulatory Push for Energy Efficiency

The FinFET Technology Market is also shaped by a regulatory push for energy efficiency in electronic devices. Governments and regulatory bodies are increasingly implementing standards aimed at reducing energy consumption and carbon footprints. This has led to a heightened focus on technologies that can deliver better performance with lower power usage. FinFET technology, known for its ability to minimize leakage current and enhance energy efficiency, is well-positioned to meet these regulatory demands. As a result, manufacturers are likely to invest in FinFET technology to comply with these regulations while also appealing to environmentally conscious consumers. This trend is expected to drive growth in the FinFET market as companies seek to align with sustainability goals.

Advancements in Semiconductor Manufacturing

The FinFET Technology Market is significantly influenced by advancements in semiconductor manufacturing processes. Innovations such as extreme ultraviolet lithography (EUV) are enabling the production of smaller transistors with improved performance characteristics. This is particularly relevant as the industry moves towards 5nm and 3nm process nodes, where FinFET technology plays a pivotal role. Data indicates that the semiconductor manufacturing sector is expected to grow at a compound annual growth rate of approximately 6% over the next five years, underscoring the importance of adopting cutting-edge technologies like FinFETs. These advancements not only enhance performance but also reduce power consumption, making them essential for next-generation applications in computing and telecommunications.

Growing Adoption of Artificial Intelligence

The FinFET Technology Market is witnessing a surge in demand driven by the growing adoption of artificial intelligence (AI) and machine learning applications. These technologies require substantial computational power, which FinFETs can provide due to their superior performance and energy efficiency. As organizations increasingly integrate AI into their operations, the need for high-performance chips that can handle complex algorithms becomes paramount. Market analysis suggests that the AI semiconductor market is projected to reach USD 70 billion by 2026, further propelling the demand for FinFET technology. This trend indicates a shift towards more sophisticated processing capabilities, positioning FinFETs as a vital component in the development of AI-driven solutions.