Top Industry Leaders in the FinFET Technology Market

*Disclaimer: List of key companies in no particular order

Competitive Landscape of the FinFET Technology Market

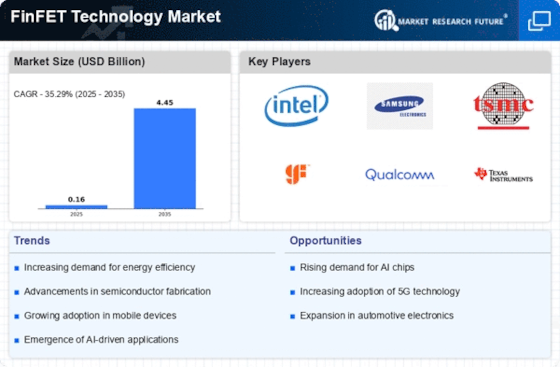

The FinFET technology market, powering our ever-shrinking and ever-powerful electronics, is a dynamic arena where titans clash and upstarts rise. Understanding the competitive landscape is crucial for navigating this complex terrain. Let's delve into the strategies, players, and factors shaping this high-stakes game.

Some of the FinFET Technology companies listed below:

- MediaTek Inc

- Xilinx Inc.

- Samsung Electronics Corporation Ltd

- United Microelectronics Corporation

- Broadcom Inc.

- Huawei Technologies Co Ltd

- Intel Corporation

- Taiwan Semiconductor Manufacturing Co Ltd

- Qualcomm Technologies Inc.

- Advanced Micro Devices Inc.

Strategies Adopted by Key Players

In this dynamic landscape, success hinges on a well-defined strategy. Continuous innovation is crucial, with companies investing heavily in R&D to develop the next generation of FinFET technology. Diversification and portfolio expansion are also key, as players cater to different market segments and applications, from mobile devices to high-performance computing.

Operational excellence and cost-efficiency are crucial to compete with the established players. Streamlined manufacturing processes, efficient supply chains, and strategic partnerships are essential for delivering competitive pricing and securing market share.

Collaboration and partnerships are becoming increasingly important. Joint ventures and technology alliances enable companies to pool resources, access new markets, and share expertise. This collaborative approach can accelerate innovation and drive growth in the FinFET market.

Factors Shaping Market Share:

Analyzing market share in the FinFET landscape involves considering several key factors:

- Technology Node Leadership: The ability to manufacture chips at the most advanced nodes (currently 5nm and below) is a crucial differentiator. Companies with this capability command higher pricing and attract premium customers.

- Production Capacity: The ability to meet the ever-growing demand for FinFET chips is vital. Foundries like TSMC and Samsung with large-scale production capabilities hold an advantage.

- Cost-Effectiveness: Balancing cutting-edge technology with affordability is key. Companies like GlobalFoundries, offering lower-cost FinFET solutions, cater to specific market segments.

- Application Focus: Catering to specific application segments, like high-performance computing or mobile devices, leads to market share gains in those areas. For example, Qualcomm's focus on mobile chipsets gives them a strong position in the smartphone market.

Emerging Players and New Trends:

The FinFET landscape is not static. New players, like United Microelectronics Corporation (UMC) and Semiconductor Manufacturing International Corporation (SMIC), are rapidly expanding their capabilities and vying for market share. Additionally, emerging trends like 3D FinFETs and gate-all-around (GAA) transistors hold the promise of further miniaturization and performance improvements, attracting investments from established and new players alike.

Latest Company Updates:

On Oct. 02, 2023- Avicena, a Sunnyvale-based company, demonstrated its chip-to-chip interconnect technology, LightBundleTM multi-Tbps, at the European Conference for Optical Communications (ECOC) 2023 in Glasgow, Scotland. This 1Tbps microLED-based Transceiver IC in 16nm finFET CMOS is part of Avicena's LightBundle multi-terabit interconnect technology.

The microLED-based LightBundle architecture can unlock the performance of processors, memory, and sensors, removing key bandwidth and proximity constraints while simultaneously offering class-leading energy efficiency.

On July 11, 2023- Cadence Design Systems, Inc. (CDNS) announced that its digital and custom/analog flows are now certified on the Intel 16 FinFET process technology, and its design IP supports this node from Intel Foundry Services (IFS). CDNS and Intel also delivered the corresponding process design kits (PDKs) to accelerate the development of a wide variety of low-power, high-performance computing (HPC) and secure U.S. Military, Aerospace and Government (USMAG) applications.

On May 16, 2023- NXP Semiconductors announced a collaboration with TSMC to deliver the industry's first automotive-embedded MRAM in 16 nm FinFET technologies. This MRAM can update 20MB of code in less than three seconds than flash memories, which take about a minute. Moreover, MRAM provides a highly reliable technology for automotive mission profiles, offering up to one million update cycles, endurance that is 10x greater than flash, and other emerging memory technologies.

On Apr. 25, 2023- Attopsemi, a provider of advanced One-Time Programmable (OTP) IP solutions, announced its revolutionary I-fuse OTP silicon-proven on FinFET Technology. I-fuse FinFET processes 12nm using metal as fuse material. Attopsemi's OTP can support a complete portfolio of process technologies from mature nodes to high-K metal gate and FinFET technologies without extra mask or Boolean masking operations.