Advancements in 5G Technology

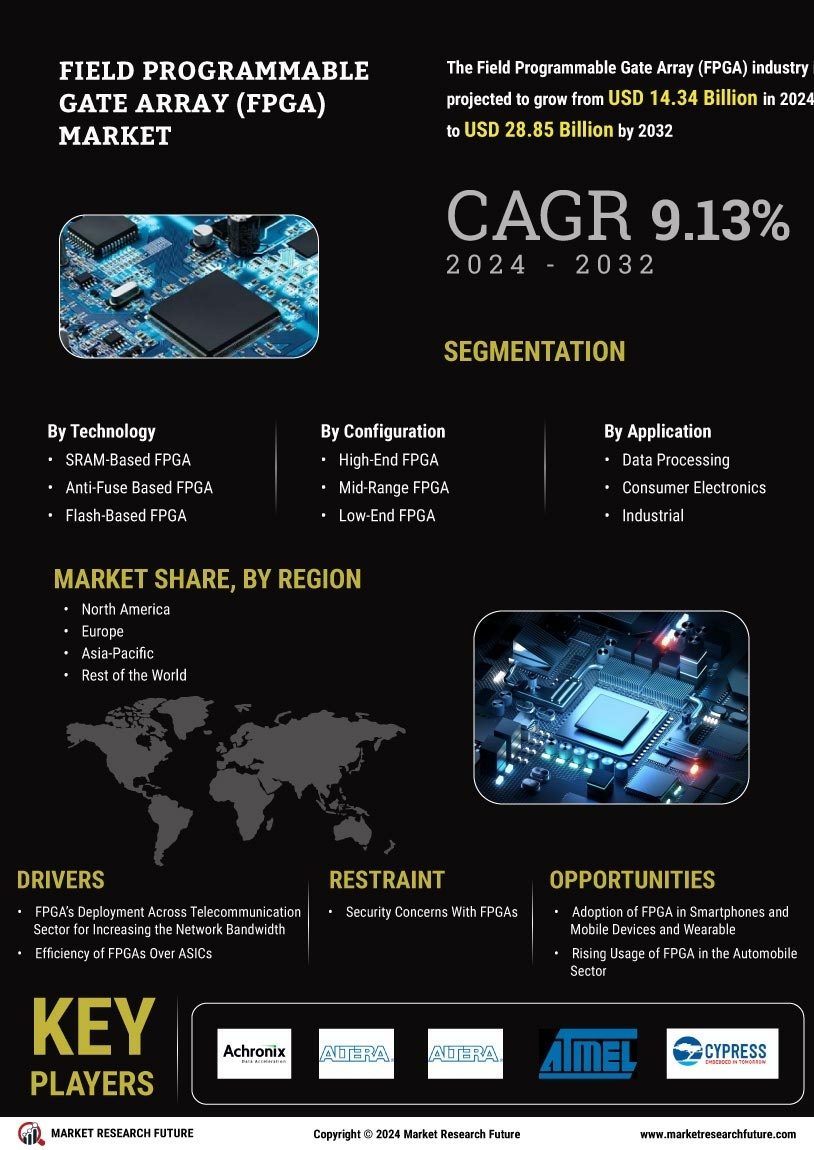

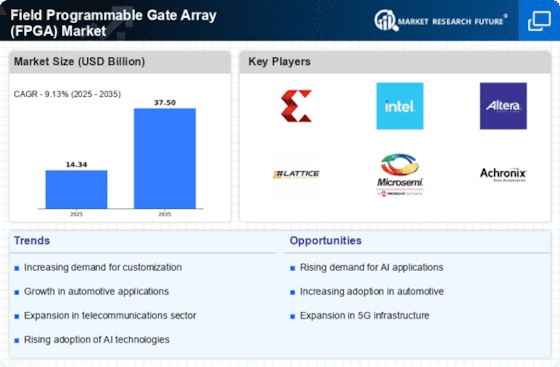

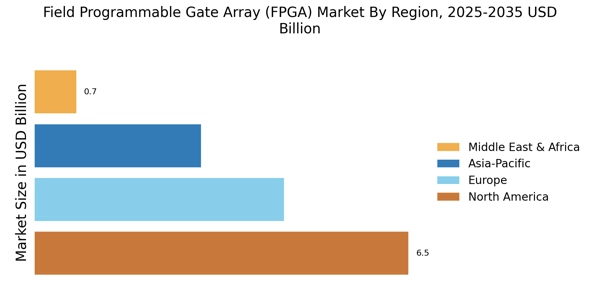

The Field Programmable Gate Array Market (FPGA) Market is significantly influenced by advancements in 5G technology. As telecommunications companies roll out 5G networks, the demand for high-speed data transmission and low latency is paramount. FPGAs play a crucial role in enabling the development of 5G infrastructure by providing the necessary processing power and flexibility to adapt to new protocols and standards. The market for FPGAs in 5G applications is projected to grow substantially, with estimates suggesting a potential increase of over 20% in the next few years. This growth is driven by the need for efficient signal processing and the ability to implement complex algorithms in real-time, making FPGAs an essential component in the evolution of telecommunications.

Increased Focus on Edge Computing

The Field Programmable Gate Array Market (FPGA) Market is benefiting from the increased focus on edge computing. As organizations seek to process data closer to the source, FPGAs offer a compelling solution due to their low latency and high performance. This shift towards edge computing is driven by the need for real-time data processing in applications such as IoT, autonomous vehicles, and smart cities. FPGAs enable efficient data handling and processing at the edge, reducing the need for extensive data transmission to centralized data centers. Market forecasts indicate that the edge computing segment is expected to grow rapidly, with FPGAs playing a pivotal role in this transformation. The ability to deploy FPGAs in diverse environments enhances their appeal, further solidifying their position in the FPGA market.

Growth in Data Center Applications

The Field Programmable Gate Array Market (FPGA) Market is witnessing significant growth in data center applications. With the increasing demand for high-performance computing and data processing capabilities, FPGAs are being integrated into data centers to accelerate workloads and enhance efficiency. The ability of FPGAs to perform parallel processing and handle complex algorithms makes them ideal for applications such as machine learning, data analytics, and real-time data processing. Recent market analysis indicates that the adoption of FPGAs in data centers is expected to grow at a compound annual growth rate of over 15% through the next few years. This trend underscores the importance of FPGAs in meeting the evolving needs of data-intensive applications, thereby solidifying their role in the broader FPGA market.

Emergence of AI and Machine Learning

The Field Programmable Gate Array Market (FPGA) Market is increasingly shaped by the emergence of artificial intelligence and machine learning technologies. FPGAs are uniquely positioned to accelerate AI workloads due to their parallel processing capabilities and adaptability. As organizations integrate AI into their operations, the demand for hardware that can efficiently handle complex algorithms is rising. Recent studies suggest that the FPGA market for AI applications could witness a growth rate exceeding 25% in the coming years. This trend highlights the potential of FPGAs to support various AI applications, from image recognition to natural language processing, thereby enhancing their relevance in the evolving technological landscape.

Rising Demand for Customizable Solutions

The Field Programmable Gate Array Market (FPGA) Market is experiencing a notable surge in demand for customizable solutions. As industries increasingly seek tailored hardware solutions to meet specific application requirements, FPGAs offer a unique advantage due to their reconfigurable nature. This flexibility allows for rapid prototyping and deployment, which is particularly appealing in sectors such as automotive, aerospace, and consumer electronics. According to recent data, the FPGA market is projected to reach a valuation of approximately 10 billion USD by 2026, driven by the need for specialized processing capabilities. Furthermore, the ability to adapt to evolving standards and protocols enhances the attractiveness of FPGAs, positioning them as a preferred choice for companies aiming to maintain competitive advantages in a fast-paced technological landscape.