North America : Market Leader in Financial Services

North America continues to lead the Financial Reporting Services Market, holding a significant share of 22.5% as of 2024. The region's growth is driven by a robust regulatory framework, increasing demand for transparency, and the adoption of advanced technologies. Companies are focusing on compliance with stringent regulations, which is further propelling market expansion. The rise in mergers and acquisitions also contributes to the demand for comprehensive financial reporting services.

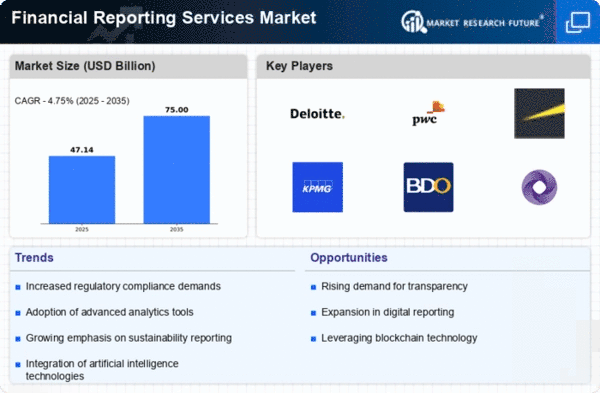

The competitive landscape in North America is characterized by the presence of major players such as Deloitte, PwC, EY, and KPMG. These firms leverage their extensive resources and expertise to cater to a diverse clientele, including large corporations and SMEs. The U.S. remains the largest market, followed by Canada, where the demand for financial reporting services is also on the rise. The focus on digital transformation and data analytics is reshaping service offerings, enhancing efficiency and accuracy.

Europe : Growing Demand for Compliance Services

Europe's Financial Reporting Services Market is witnessing significant growth, with a market size of €12.0 billion. The demand is primarily driven by evolving regulatory requirements and the need for enhanced financial transparency. Countries like Germany, France, and the UK are at the forefront, pushing for stricter compliance measures. The European Union's initiatives to standardize financial reporting practices are also acting as catalysts for market expansion, ensuring that firms adhere to best practices.

The competitive landscape in Europe features key players such as BDO, Mazars, and Grant Thornton, alongside the global giants. The UK remains a pivotal market, with London being a hub for financial services. The presence of diverse industries, from manufacturing to technology, creates a robust demand for tailored financial reporting services. As firms adapt to new regulations, the focus on sustainability and corporate governance is becoming increasingly important, shaping the future of the market.

Asia-Pacific : Emerging Markets on the Rise

The Asia-Pacific region is emerging as a significant player in the Financial Reporting Services Market, with a market size of $8.0 billion. The growth is fueled by rapid economic development, increasing foreign investments, and a growing emphasis on corporate governance. Countries like China, India, and Australia are leading the charge, with businesses seeking to enhance their financial reporting standards to attract global investors. The region's diverse economic landscape presents unique challenges and opportunities for service providers.

In Asia-Pacific, the competitive landscape is evolving, with both local and international firms vying for market share. Key players are adapting their services to meet the specific needs of various industries, including technology and manufacturing. The demand for digital solutions and automation in financial reporting is on the rise, driven by the need for efficiency and accuracy. As regulatory frameworks become more stringent, firms are increasingly investing in compliance and risk management solutions to stay ahead in this dynamic market.

Middle East and Africa : Untapped Potential in Financial Services

The Middle East and Africa (MEA) region presents a unique opportunity in the Financial Reporting Services Market, with a market size of $2.5 billion. The growth is driven by increasing economic diversification, particularly in the Gulf Cooperation Council (GCC) countries, where there is a strong push for transparency and accountability in financial reporting. Governments are implementing reforms to enhance regulatory frameworks, which is expected to boost demand for financial reporting services across various sectors.

In the MEA region, countries like the UAE and South Africa are leading the market, with a growing number of firms seeking professional financial reporting services. The competitive landscape is characterized by a mix of local and international players, each striving to establish a foothold in this emerging market. As businesses expand and seek to comply with international standards, the demand for specialized financial reporting services is set to rise, creating a fertile ground for growth.