North America : Market Leader in Innovation

North America leads the Environmental Monitoring and Reporting Services Market, holding a significant share of 5.0 in 2024. The region's growth is driven by stringent environmental regulations, increasing public awareness of environmental issues, and technological advancements in monitoring systems. The demand for real-time data and compliance with regulations further fuels market expansion, making it a pivotal area for environmental services.

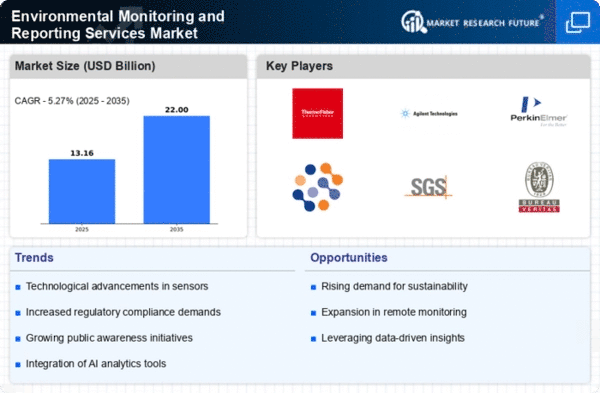

The United States and Canada are the primary contributors to this market, with key players like Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer dominating the landscape. The competitive environment is characterized by continuous innovation and partnerships aimed at enhancing service offerings. The presence of established firms ensures a robust supply chain and a wide range of services, catering to various sectors including industrial, governmental, and environmental agencies.

Europe : Regulatory Framework Driving Growth

Europe's Environmental Monitoring and Reporting Services Market is valued at 3.5, reflecting a strong commitment to sustainability and regulatory compliance. The region benefits from comprehensive environmental policies and initiatives aimed at reducing carbon footprints and enhancing ecological monitoring. The European Union's Green Deal and various national regulations are key drivers, promoting investments in environmental technologies and services.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with companies like Eurofins Scientific and SGS playing crucial roles. The competitive landscape is marked by a mix of established firms and innovative startups, all striving to meet the growing demand for environmental accountability. The emphasis on sustainable practices and compliance with EU regulations positions Europe as a leader in environmental monitoring services.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region, with a market size of 2.5, is rapidly emerging in the Environmental Monitoring and Reporting Services sector. The growth is primarily driven by increasing industrialization, urbanization, and a rising awareness of environmental issues among the populace. Governments are implementing stricter regulations to combat pollution and promote sustainable practices, which is further propelling market demand.

Countries like China, India, and Japan are leading the charge, with a mix of local and international players such as EnviroSuite and AquaMetrix establishing a presence. The competitive landscape is evolving, with companies focusing on innovative solutions to meet regulatory requirements and consumer expectations. As environmental concerns gain traction, the region is poised for significant growth in monitoring services.

Middle East and Africa : Growing Focus on Sustainability

The Middle East and Africa region, with a market size of 1.5, is gradually recognizing the importance of Environmental Monitoring and Reporting Services. The growth is driven by increasing industrial activities, urbanization, and a growing emphasis on sustainability and environmental protection. Governments are beginning to implement regulations aimed at improving environmental standards, which is fostering demand for monitoring services.

Countries like South Africa and the UAE are leading the market, with a mix of local and international players entering the space. The competitive landscape is characterized by a focus on innovative technologies and partnerships aimed at enhancing service delivery. As awareness of environmental issues grows, the region is expected to see a rise in investments in monitoring services.