Expansion of E-commerce

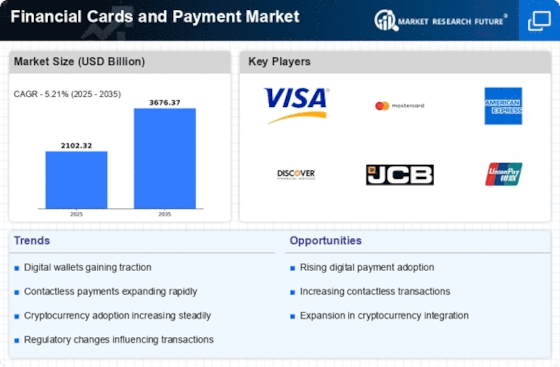

The expansion of e-commerce has been a pivotal driver for the Financial Cards and Payment Market. As online shopping continues to gain traction, consumers increasingly rely on financial cards for seamless transactions. In 2025, it is estimated that e-commerce sales will account for a substantial portion of total retail sales, further propelling the demand for secure and efficient payment methods. This trend indicates a shift in consumer behavior, where convenience and speed are paramount. Consequently, financial institutions and payment service providers are adapting their offerings to cater to this growing market segment, enhancing their digital payment solutions. The Financial Cards and Payment Market is likely to witness innovations aimed at improving user experience, thereby fostering greater adoption of financial cards in online transactions.

Adoption of Mobile Wallets

The adoption of mobile wallets represents a significant trend within the Financial Cards and Payment Market. With the proliferation of smartphones, consumers are increasingly utilizing mobile wallets for everyday transactions. As of 2025, it is projected that mobile wallet usage will surpass traditional payment methods in various regions. This shift is driven by the convenience and speed that mobile wallets offer, allowing users to make payments with a simple tap or scan. Furthermore, the integration of loyalty programs and promotional offers within mobile wallets enhances their appeal, encouraging more consumers to adopt this technology. Financial institutions are responding by developing partnerships with mobile wallet providers, thereby expanding their reach within the Financial Cards and Payment Market.

Emergence of Cryptocurrencies

The emergence of cryptocurrencies is influencing the Financial Cards and Payment Market in profound ways. As digital currencies gain acceptance, financial institutions are exploring ways to integrate cryptocurrency transactions into their payment systems. By 2025, it is anticipated that a growing number of consumers will seek to use cryptocurrencies for everyday purchases, prompting financial card providers to adapt their offerings. This shift may lead to the development of hybrid financial cards that support both traditional currencies and cryptocurrencies. The Financial Cards and Payment Market is likely to experience increased competition as new players enter the market, offering innovative solutions that cater to the evolving preferences of consumers.

Regulatory Changes and Compliance

Regulatory changes and compliance requirements are shaping the landscape of the Financial Cards and Payment Market. Governments and regulatory bodies are increasingly implementing stringent measures to enhance consumer protection and data security. For instance, the introduction of regulations aimed at combating fraud and ensuring transparency in transactions has compelled financial institutions to invest in advanced security technologies. As of 2025, compliance with these regulations is not only a legal obligation but also a competitive advantage. Institutions that prioritize compliance are likely to build trust with consumers, thereby increasing their market share. This trend underscores the importance of regulatory frameworks in driving innovation and shaping the future of the Financial Cards and Payment Market.

Technological Advancements in Payment Processing

Technological advancements in payment processing are driving transformation within the Financial Cards and Payment Market. Innovations such as blockchain technology, artificial intelligence, and machine learning are enhancing the efficiency and security of payment transactions. As of 2025, it is expected that these technologies will streamline payment processing, reduce transaction times, and minimize fraud risks. Financial institutions are investing heavily in these technologies to remain competitive and meet the demands of tech-savvy consumers. The integration of advanced analytics also allows for better risk assessment and fraud detection, further solidifying the role of technology in shaping the future of the Financial Cards and Payment Market.