Rising Demand for Organic Produce

The increasing consumer preference for organic produce is a pivotal driver for the Biofungicides Market. As consumers become more health-conscious, they are gravitating towards food products that are free from synthetic chemicals. This trend is reflected in market data, which indicates that the organic food sector has been experiencing a compound annual growth rate of approximately 10%. Consequently, farmers are seeking effective biofungicides to protect their crops while adhering to organic farming standards. The Biofungicides Market is thus positioned to benefit from this shift, as it offers solutions that align with the growing demand for sustainable agricultural practices. The emphasis on organic farming not only enhances soil health but also contributes to biodiversity, making biofungicides an attractive option for modern agricultural practices.

Environmental Regulations and Compliance

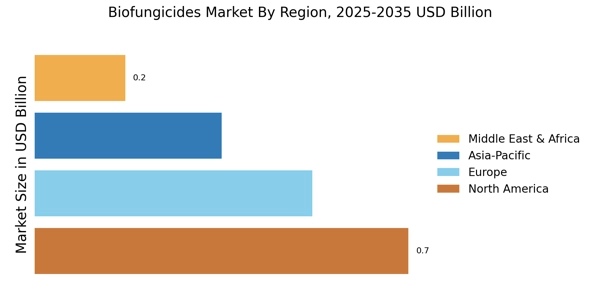

Stringent environmental regulations are increasingly shaping the Biofungicides Market. Governments worldwide are implementing policies aimed at reducing the use of harmful chemical pesticides, which has led to a surge in demand for eco-friendly alternatives. For instance, regulations in various regions are promoting the adoption of bio-based solutions, which are perceived as safer for both human health and the environment. This regulatory landscape is encouraging agricultural producers to transition towards biofungicides, as they offer compliance with these evolving standards. Market data suggests that the biofungicides segment is expected to grow at a rate of around 12% annually, driven by these regulatory pressures. As a result, the Biofungicides Market is likely to see increased investment and innovation in developing effective biofungicide products that meet regulatory requirements.

Technological Innovations in Biofungicides

Technological advancements in biotechnology are significantly influencing the Biofungicides Market. Innovations such as genetic engineering and microbial formulations are enhancing the efficacy and application of biofungicides. These technologies enable the development of more targeted and effective biofungicides that can combat a wider range of fungal pathogens. Market data indicates that the biofungicides segment is projected to reach a valuation of several billion dollars by the end of the decade, largely due to these technological improvements. Furthermore, the integration of precision agriculture techniques is allowing for more efficient application of biofungicides, thereby maximizing their effectiveness. As a result, the Biofungicides Market is poised for substantial growth, driven by the continuous evolution of biotechnological solutions.

Increased Awareness of Sustainable Practices

The growing awareness of sustainable agricultural practices is a crucial driver for the Biofungicides Market. Farmers and agricultural stakeholders are increasingly recognizing the long-term benefits of adopting sustainable methods, which include improved soil health and reduced environmental impact. This shift in mindset is leading to a greater acceptance of biofungicides as viable alternatives to traditional chemical fungicides. Market data suggests that the adoption of sustainable practices is expected to rise, with a significant portion of farmers indicating a willingness to invest in bio-based solutions. Consequently, the Biofungicides Market is likely to experience a surge in demand as more agricultural producers seek to align their practices with sustainability goals. This trend not only supports environmental conservation but also enhances the overall resilience of agricultural systems.

Growing Investment in Research and Development

Investment in research and development is a vital driver for the Biofungicides Market. As the agricultural sector seeks innovative solutions to combat plant diseases, funding for R&D in biofungicides is increasing. This investment is crucial for developing new formulations and improving existing products, ensuring that they meet the evolving needs of farmers. Market data indicates that R&D spending in the bio-based sector is projected to grow significantly, reflecting the industry's commitment to innovation. Furthermore, collaborations between academic institutions and industry players are fostering the development of cutting-edge biofungicides. As a result, the Biofungicides Market is likely to benefit from a continuous influx of new products and technologies, enhancing its competitiveness and effectiveness in addressing agricultural challenges.